ByteDance sees China’s $ 1.7 trillion e-commerce share | Business and Financial Issues

Zhang Yiming built ByteDance Ltd. becoming the most valuable company in the world through several blockbuster programs like TikTok which criticized Facebook and others who did the same. His most recent goal: Alibaba.

A 38-year-old AI student specialist, investigator of ByteDance’s next major action, is looking at China’s $ 1.7 trillion e-commerce. His partner recruited thousands of people and paid for sponsors known as Xiaomi Corp. impresario Lei Jun to drive what he calls the “biggest success” following global business – selling goods to consumers through its short videos and streams. This is not only a test of Zhang’s magic in software development and ByteDance’s AI wizardry, but also a vendor reception ahead of another highly anticipated IPO.

Its inception has already begun to create waves in companies owned by Jack Ma’s Alibaba Group Holding Ltd. by JD.com Inc. It sold nearly $ 26 billion in manufacturing, clothing and other items in 2020, which was completed in its first year which Alibaba’s Taobao took six years to achieve. It is grossing more than $ 185 billion by 2022. Douyin, the Chinese twin at TikTok, is expected to provide more than half of its $ 40 billion home sales this year, slightly driven by e-commerce.

Shawn Yang, chief executive of Blue Lotus Capital Advisors, said: “Short films have as many cars as they can do any business.” “Douyin is not limited to advertising, but also live broadcasting, e-commerce, livelihoods and hunting. This has a lot to think about.”

The fast-growing online business could help the company raise more than $ 250 billion in revenue, tackling concerns over the Beijing boredom of the country’s behemoths. Preparations are said to be taking place on a list that could be one of the most anticipated competitions in the world. The startup is working with consultants at the conference and is choosing between Hong Kong and the US as the venue, people familiar with the matter say. While ByteDance may not handle sales or marketing on its own, it hopes to sell more promotions to retailers, boost traffic and reduce business.

The online giant has recently arrived in China on a commercial basis, which promotes all things for fans like the Gen-Z brand of Home Shopping Network. The brand, developed by Alibaba as a promotional tool in 2016, came to life on its own last year when the Covid-19 promoted domestic demand. Last year, Alibaba’s Taobao Live made more than $ 400 billion ($ 62 billion) worth of total sales and Kuaishou Technology’s social networking site had 381 billion downloads, more than two Douyins.

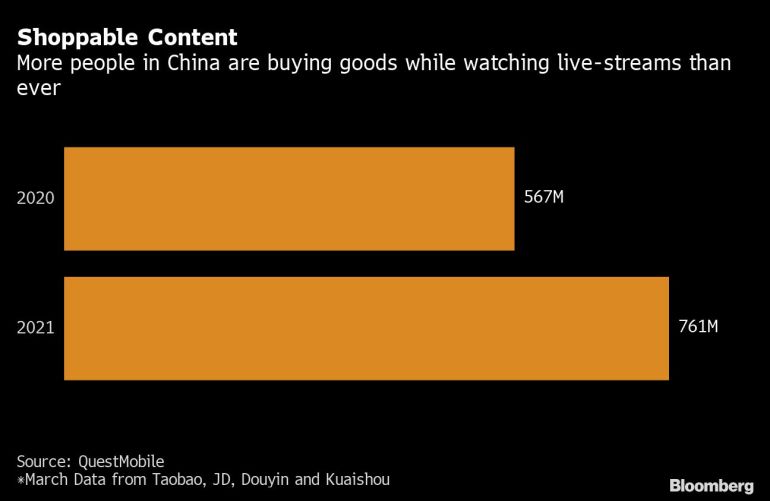

ByteDance relies on its creative, innovative ideas to help its e-commerce business find itself. At a one-year business launch last month, executives expressed that the company wants to replicate its success by using AI algorithms to feed users in online shopping. By highlighting the growing number of people, who are now connected to the material world more than ever before, Douyin users will not be deterred by their desire to buy, he said.

“It’s like street shopping,” Bob Kang, a 35-year-old e-commerce salesman in Douyin, told hundreds of listeners at the event in Guangzhou. “When people get rich, they don’t go to the mall or to the mall with other things in mind, they only buy if they see something they like.”

Kang, a former engineer of Baidu Inc. who was retained by ByteDance in 2017, is one of the oldest active executives Zhang founded the company. He was previously the technical director of ByteDance’s Helo program, one of India’s most widely used video sharing platforms – until South Asia closed down with a number of Chinese programs last June in national security.

Since Kang took over e-commerce, Douyin banned advertisers from selling third-party content and asked them to open their own site, protecting competitors such as Alibaba and JD.com Inc. the amount. He has developed a team of customer service staff ranging from one hundred to 1,900 to fight fraud and is hiring more than 900 other locations to support the business. ByteDance also has an online integration system that helps connect merchants and advertisers with their organizations, and has been set up to accommodate advertisers and businesses, similar to what Alibaba does.

The project was attracted by well-known people such as Lei, the founder of Xiaomi who developed a way to advertise his TV and mobile phones. Luo Yonghao, a well-known businessman who fought against Apple Inc. with its smartphone business, it is another major developer, transferring more than $ 17 million on its first commercial platform.

Small business owners are following in their footsteps, such as Zhou Huang, who set up a shopping center in Douyin in his precious stone business in October, crossing a common platform like Alibaba’s Taobao. Instead of making millions of dollars for the users of the platform, it has managed to reach nearly 20,000 people by creating videos that offer practical advice on how to choose the right size when buying a bracelet online.

“It’s difficult for new traders like me to attract customers to Taobao,” said Huang, whose Douyin store collapsed even after only three months. “Sometimes people come to our store not to buy things, but to enjoy themselves. But when we have enough visitors, we can sell. ”

ByteDance is bringing a hand. In Foshan, Huang and 200 other jewelry retailers are trained in everything from store registration and advertising to high-quality animation. Periodic technical support is available: Huang says that whenever his circulatory system descends, ByteDance experts immediately assist.

Huang is one of the nearly 1 million e-commerce developers in Douyin since January, attracted by 600 million users on a daily basis. The platform – which brings in entrepreneurial fees as a new way to earn money – aims to make more than a thousand this year to join Suning.com Co in setting up a shopping mall in Douyin, and that number could increase fivefold by 2022, the company predicted on the internal index. GMV could grow to 600 billion yuan this year before returning to 1.2 trillion yuan in 2022.

ByteDance goals are not limited to Alibaba. The company has also started allowing users to book restaurants and restaurants via Douyin, offering similar services to high-end apps like Meituan and Tencent’s WeChat.

The e-commerce market in Douyin, China can provide a map of TikTok, which has tried to test the waters by purchasing items through Wal-Mart Inc. and Canadian company e-commerce Shopify Inc. Back in December, Zhang told staff around the world that e-commerce, combined with visual and video content, would provide greater opportunities outside of China, according to attendees who asked not to be identified. The company has been quietly developing a team of engineers in Singapore to grow the new TikTok business operations.

ByteDance’s insistence on online shopping comes at a time when some of its businesses are facing challenges. Growing up in video games, ByteDance has been purchasing promotional studios but producing blockbusters like Tencent Holdings Ltd. Honors of Kings could take years and China has already done the job well and started. With the advent of online marketing, developers strive to be more marketable and competition is fiercely against startups with big bags like Zuoyebang sponsored by Alibaba.

In April, Zhang’s company was one of 34 organizations commissioned by antitrust regulators to undertake internal audits and develop more. And even though its payroll has only recently declined, ByteDance and its associates have been hit by a series of fast-track workplace restrictions following a meeting with regulators including the central bank last month.

But the same review could help the owner of TikTok enter China e-commerce, the world’s largest online marketplace. Alibaba has arrested rivals JD.com and Pinduoduo Inc. over the past 10 years they have been accused of adopting commercial practices. Authorities have long paid a $ 2.8 billion fine to Jack Ma’s largest company and abolished “choosing one of two” for one of their main competition goals, giving potential entrants like ByteDance a chance.

In the meantime, the biggest and most momentous promotion from ByteDance’s growth to e-commerce is money marketing, which also makes the most of it. The number of traders in Douyin is growing, as are their businesses being used on the platform. Solid e-commerce activities can go beyond games to make them more effective in advertising. At the Kuaishou competition, traders contributed about 20%, the company said in March.

“It’s about getting a large share of advertising sales from products that would be costly on a platform like Alibaba,” said Michael Norris, senior researcher at Shanghai’s market research company at AgencyChina. “This is where the Alibaba threat comes from.