Oil closes below $ 90 per barrel for a second day | Oil and Gas News

The possibility of a nuclear deal with Iran could bring some relief to a tight oil market.

By Bloomberg

Published On 9 Feb 2022

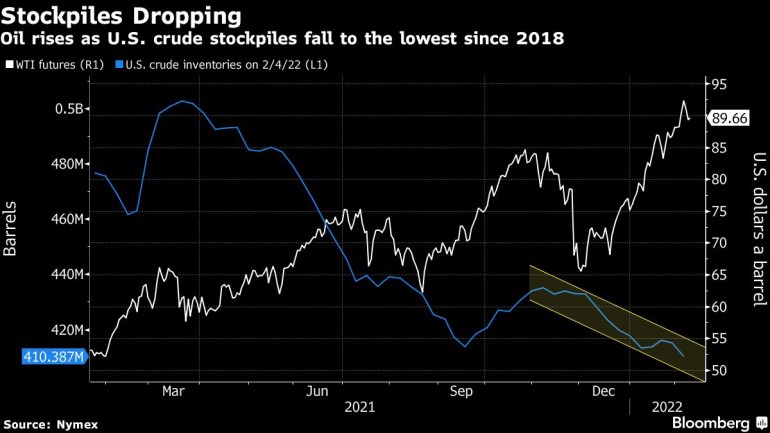

Oil closed below $ 90 a barrel for a second day as the possibility that a nuclear deal with Iran could bring relief to a tight market overshadowed a big drop in US crude stockpiles.

Futures in New York ended Wednesday’s session just 0.3% higher, paring earlier gains, as a flurry of diplomacy in Vienna has spurred renewed optimism of a breakthrough in nuclear talks. In the morning, prices had risen as much as 1.4% after a government report showed US crude inventories fell to the lowest level since 2018 amid record demand.

“Rising demand often comes hand-in-hand with upward price movements, but a long-awaited supply relief could be around the corner, helping to narrow the imbalance and cool market sentiment,” said Louise Dickson, Rystad Energy’s senior oil markets analyst.

Oil’s rally had paused this week after a run of seven weekly gains propelled prices to the highest since 2014. The possibility of more Iranian oil comes as global supply has increasingly been unable to keep up with surging demand from emerging economies from the pandemic. OPEC + is struggling to meet its pledged output increases, in part due to outages in Libya, while traders are looking to see how much the US shale patch will lift output this year. Meanwhile, France’s President Emmanuel Macron suggested the political tension around Ukraine could ease.

US crude stockpiles fell 4.76 million barrels, according to an Energy Information Administration report. Additionally, the four-week average for US oil-product supplied, a gauge for demand, rose last week to a record high.

Combined US supplies of refined products and crude oil have not been this low since 2015, with inventories draining steadily since the summer of 2020 as demand has rebounded from the depths of the pandemic-induced lockdowns. Crude futures, as well as other commodities, are in backwardation, a structure indicating traders are paying a premium for closer-dated deliveries, as inventories continue to tighten.

Prices

- West Texas Intermediate for March delivery rose 30 cents to settle at $ 89.66 a barrel in New York

- Brent for April settlement rose 77 cents to settle at $ 91.55 a barrel

Meanwhile in Washington, White House Economic Adviser Jared Bernstein said in an interview on CNN that releasing more crude reserves is an “option that can be put on the table as needed” to help tackle gasoline prices. That tactic, however, has had little impact so far, with motor fuel rising to the highest in more than seven years.

Other market news:

- Private investment firm BlueCrest Capital Management, co-founded by billionaire Michael Platt, has been on a hiring spree for traders who can cash in on a blistering rally in commodities, people familiar with the matter said.

- Almost two years after widespread Covid-19 lockdowns began, traffic in the world’s cities still hasn’t returned to normal.

- US oil output will grow more than the government previously expected as a price rally drives producers to boost drilling.