How the plague increased the price of Japanese retailers

This article is the third in a series of FT series exploring the future of business

Hiroshi Mikitani, a billionaire in Japan, enjoys a business venture that burns his reputation as the world’s largest business evangelist.

Rakuten, a Mikitani company founded in 1997 and sold to the largest online retailer in Japan, has taken part in sending Viber and US messaging coupons and Ebates refunds.

It’s the record that explains why his recent contract has brought so much interest. Instead of investing in the new program, Mikitani agreed at the end of March to sell an 8% stake in Rakuten to the Japan Post, a former government correspondent and a strong brick and mortar brand in the country’s $ 5tn economy.

Coming a year after the epidemic that has caused so much fear for retailers in recent decades, the deal was seized as evidence that it will soon be out of control of retail stores to reach Japanese consumers.

In addition to the money, Rakuten will greatly expand its delivery channels and put its name in front of older retailers who use the post. Japan Post, meanwhile, is able to set up an online retailer’s payment by paying and using a lot of customer information.

“The key to the deal is that the Japan Post, which has a large sales department, is affiliated with Rakuten, who is engaged in the largest digital business,” Hiroshi Takasawa, chief executive, told the Financial Times.

If the alliance is a reminder that the roots of the brick-and-mortar trade in the country are more efficient than other major economies, no one can deny that the plague has changed the way Japan exports.

Akio Yoshida, President of Aeon, Japan’s largest company, did not speak directly to investors in the past month.

“The growth of Covid-19 has dramatically changed the purchasing power, attitudes and profitability,” he said. Technology has infiltrated our entire lives. ”

Footprints

This poses a serious challenge to the 7m population and has over the past decade been divided into a wide range of clients: large seniors on sale and a group of young people, the highest number of consumers in numbers.

Hiroshi Mikitani’s sale price from Rakuten to Japan Post is a symbol of bricks and mortar for sale © Keith Bedford / Bloomberg

Population is one of the main reasons why the world of technology has slowed down the use of ecommerce.

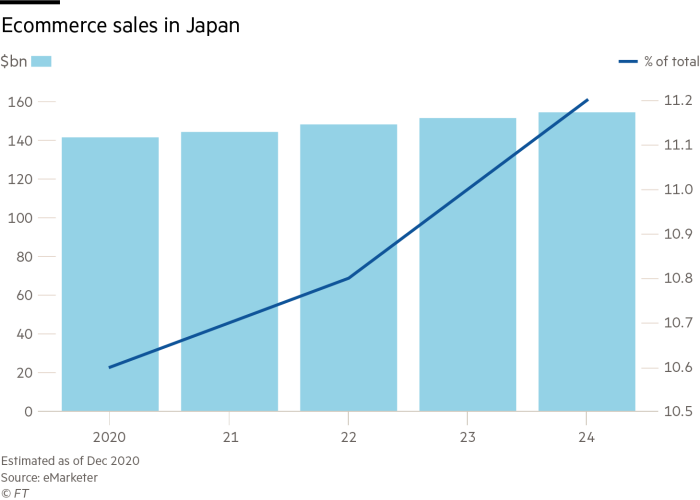

The website will account for about 11% of Japan’s sales by the end of this year, according to eMarketer research. In contrast, technology predicts that online sales account for 52% of total Chinese exports at the end of the year, 15% in the US and 13% in Western Europe.

But as Japan develops another state of emergency to reduce the prevalence of Covid-19 infections before the Olympics, retailers have no idea what the effects of the epidemic will look like.

There are some symptoms that are afraid of getting caught in the foot while new habits are permanent. Nowhere does this sound better than Isetan Mitsukoshi, a 348-year-old retailer who sells everything from high-end bags and room utensils to traditional sweets.

FT Series: Business Future

These articles will look at:

Walmart vs Amazon: grocery warfare

How something determines the future of a purchase

Do online markets meet their tastes?

When the government announced the emergency last year, the company was forced to adopt new habits. Staff turned to Zoom online video and messaging software to meet an influx of requests from customers who want to be able to purchase online wallets during school start-ups in April.

The group has been developing its own mobile app which assumes that all 1m products sold at its Shinjuku supermarket are available online. The app also provides an opportunity for customers to ask their sellers almost.

“We have seen that we can offer services that are not available on Amazon or Rakuten if our stylists are able to provide advice to customers who need such encouragement before making the decision to buy something. [online], ”Says Tomohide Sanbe, an elder in the Isetan Mitsukoshi.

“We have come to the point where we have to reconsider the meaning of our lives,” he added.

Yuko Shimomura, who works for a business company in Tokyo, said the challenges of the Covid-19 have changed the way they sell.

Shimomura, 40, said: “I don’t mind going to the mall.

Approaching the final game

It is not difficult to find skeptics who believe that Isetan’s experiments will be less expensive, too late as the website reaches consumers.

“The authorities have ignored the digital transformation process because of their reliance on stores,” said Sho Kawano, Japan’s chief executive officer at Goldman Sachs, Isetan said. “Things would have been much different if Isetan had strengthened digital experimentation 10 to 15 years ago. It is almost over.”

Isetan Mitsukoshi’s traditional shopping mall was forced to adapt to the online demands of school bag bags last year

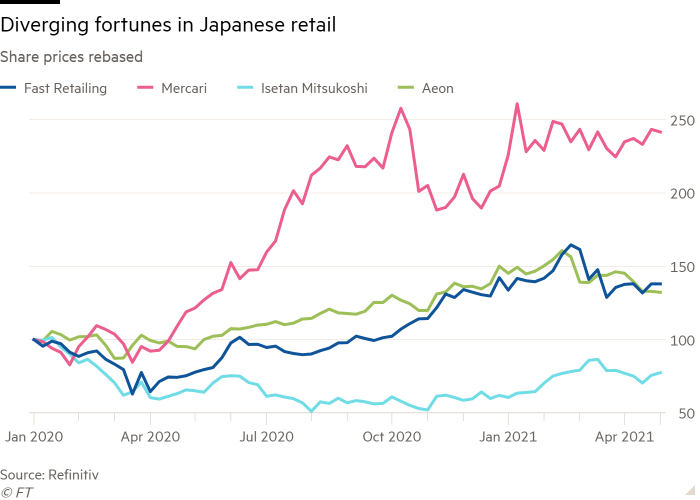

Even before the epidemic, the mix and disinterest in other traditional retailers had opened up opportunities for rivals such as digital Zozo and the Mercari market app. Out of desperation, they are successful.

Shares at Mercari, which were announced publicly in 2018, recorded new ones earlier this year when younger generations of Japanese customers used the app to sell handmade clothing, handbags and more. Revenue rose 41% to record ¥ 28.6bn ($ 261m) in the first three months of the year.

The popularity of the Zozotown online empire, which manages Yahoo Japan Z Holdings, has also exploded.

Unlike these online experts, the store remains in the heart of Ito- Yokado, one of Japan’s largest supermarkets. Encouraged by this challenge, the company is experimenting with a new way to differentiate between its 132nd site and its ecommerce business.

In September, when Yoshihide Suga took over the job and promised to revive the economy, the company launched a project to provide 400 new types of vegetables, fruits, meat and fish to homes for the elderly that call by telephone.

“We are seeing more of a world that connects the internet with the internet and there will be a need for collaboration between major online stores, delivery services, Ito-Yokado retail, and retail outlets,” Futoshi Shibata, chief executive said in an interview.

When this problem confuses ordinary retailers, there is one company that promotes it.

List the benefits

Fast Retailing, the owner of Uniqlo fashion, has been praised for being a rare example of a company that can sell online and use smart technology in its ubiquitous stores..

Uniqlo same sales increased 5.6% between September and February from a year ago, while online sales rose 41%. Fast Trading, which has a market capitalization of $ 86bn, is expected to make an annual profit this year.

Unexpected results, say experts, are the experiments that Uniqlo did online and physically. Robots are now in control of its storage space, speeding up the selection of incoming goods. It launched its own free payment program, its most recent effort to get the most out of its clients.

“Whether they are online or not, customers eventually want to buy the items they want at the time they want,” said Xiaozhou Wang, chief global fast Retailing operations manager for ecommerce. “People want to try on their own clothes and we want to connect with our customers. But the internet also helps because it is open 24 hours a day and you know a lot about customers.”

Few doubt that Japanese consumers in the long run will have more flexibility in online shopping. But as companies face huge losses over the years, the message from buyers to retailers of the future is unforgivable: stay tuned online and in stores if you want our business.

Source link