Global sales offer a third year of double-digit acquisition

Global markets closed in 2021 and gained two numbers for the third consecutive year, as simple monetary policy and the flood have helped boost wealth from plague.

The FTSE All-World share index rose 16.7% in dollar terms in 2021, surpassing the 14.1% gain last year, but soon against the blockbuster 24% jump in 2019, the year before the coronavirus crisis.

Investors came to the 2021 bullish average next year, vaccines are starting to be released and the need for stability is expected to bring about a recession.

Support from several major banks around the world has helped boost financial markets, boosted by government incentives and resumed from the more complex sanctions imposed to test the Covid-19 virus.

The expectation that the central bank will withdraw temporary aid in the financial markets, as well as the rise in Covid-19 cases due to the widespread spread of Omicron, threatening to change investors’ finances by the end of the year. However, stock markets continued to be so volatile that even hiding their findings failed to disrupt the meeting.

The Global Indicator gained about 1 percent of its peak from September to December 31.

“It’s been amazing,” says Kristina Hooper, a senior international market expert at Invesco. “Financial comments, economic incentives and vaccinations have become powerful marketing engines.”

These favorable conditions have helped keep business finances back from the losses that occurred in 2020 when the plague hit the economy.

Companies were able to promote inflation, because the demand for the economy exceeded the volume of goods, which allowed them to profit and reopen the global economy.

In the US, annual interest rate is expected to reach 45 percent when quarterly reports reach, which is the highest according to data from FactSet back to 2008.

“There is a decrease in all the good you can think of, the rising prices, political conflicts, racial and ethnic strife, there are also some of the good things that companies get,” said Jim Paulsen, a financial analyst at Leuthold Group. “It is strange but difficult for the stock market to settle down in the face of such a revival.”

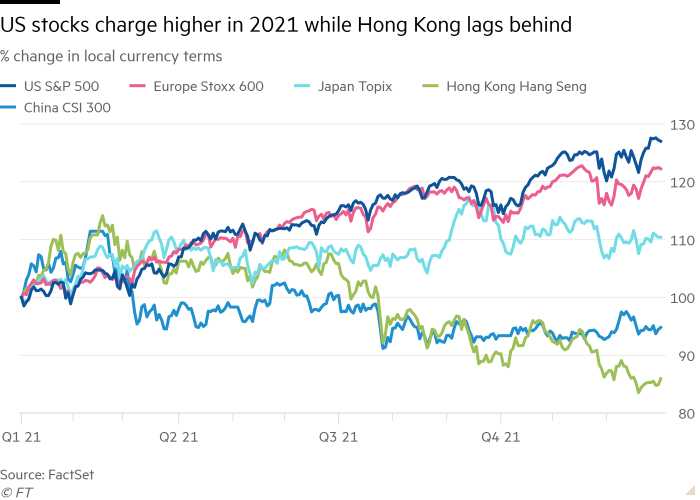

The growth of global markets has been particularly noticeable in the US. Wall Street’s blue-chip S&P 500 gauge rose about 27% this year, led by a strong 50 percent increase while oil prices rose, followed by a rise in prices of more than 40 percent.

Devon Energy climbed the list and gained about 190 percent. Eleven companies increased their price, including Ford Motor, Moderna and Marathon Oil.

This reflects change from the past two years as the technical sector, which still achieved a 33% profit in 2021, boosted the market. Cathie Wood’s Ark Innovation sales fund fell 23 percent this year, recovering its assets from a 150 percent meteoric by 2020, made up of bets on some of the companies that are making the most of the epidemic.

Nonetheless, major technical stocks remained the main contributors to the S&P 500 gains. Their significant growth compared to other companies led to a lower share price, due to its weight.

Six contributors to the success of the S&P 500 were all major technical names, led by Microsoft and Apple, the two largest companies in the world in terms of market share. Behemoths, which are priced at $ 2.5tn and $ 2.9tn, respectively, rose 51 percent and nearly 34 percent last year.

Tech continued to push markets across the Atlantic Ocean, generating 22 percent of the pan-European Stoxx 600 index. This represents the second best performance on the list since 2009, which is about to achieve 23% in 2019.

In Asia, Japanese stocks also enjoyed a strong year, the Topix index rose 10.4 percent, compared with a slight rise of 5 percent in 2020.

However, in contrast to the strong gains in the developed markets, Hong Kong’s Hang Seng index sank to more than 14 percent, burdened by Beijing’s criminality, which focuses on education and technology sectors. China CSI 300 index is down 5 percent lower.

The decline contributed to a 5.3 percent decline in dollar prices on the basis of the MSCI Emerging Markets index. The MSCI corresponding index separating Chinese stocks rose by more than 9 percent.

By 2022, investors will remain optimistic that stocks will continue to rise.

Covid-19 cases continue to spread around the world amid concerns over how these new challenges could affect chains, inflation and corporate performance. Dizzying stock market shaking following the release of the Omicron brand he emphasized how confident they can be shaken and unexpected epidemics.

At the same time, tightening monetary policy offers another hope for the coming year.

US Federal Reserve officials expects to raise interest rates three times by 2022, as the central bank moves into inflationary pressures. The Fed also announced plans in December to double its withdrawal of its $ 120bn-month spending plan.

Even so, rising prices for goods and services mean that they will continue to be interested in the new year, “said a number of investors. Even with fear.

“I think there has been a revision by the end of the first quarter. Not a steady stream but a correction,” said Andrew Brenner, chief financial officer at National Alliance Securities. “But nothing can stop the equity gathering for the first half of the year.”

Unhedged – Markets, money and strong ideas

Robert Armstrong shares what is most important in the market and discusses how well Wall Street positive ideas respond. Enter Pano so that the letter can be sent directly to your inbox every Sunday

Source link