Exxon, Chevron produces more money for free than a year | Coronavirus News Plague

Reinforcing unsustainable prices and the need for chemicals used in plastics beyond what has been lost in the refining process as many North American oil explorers report their results in the first quarter on Friday.

Exxon Mobil Corp. and DRM Corp. produced more than a single year as the global economy slipped from closure, boosting energy efficiency.

Reinforcing unsustainable prices is the need for more chemicals used in plastics than it has eliminated crude oil as North American researchers announced the results of the first quarter on Friday.

Despite meeting Wall Street expectations, DRM shares fell by 2.4% after frustrating women who hoped to be revived by sharing shares. Although Exxon’s massive losses were offset by drug profits, the stock declined by 1.7%.

All supermajors are also making money after 30% annual non-profit meetings over $ 65 a barrel, encouraged by the increase in physical strength as the economy emerges from the epidemic and OPEC is working on significant growth. BP Plc, Royal Dutch Shell Plc and Total SE all led their US counterparts with greater profits than expected.

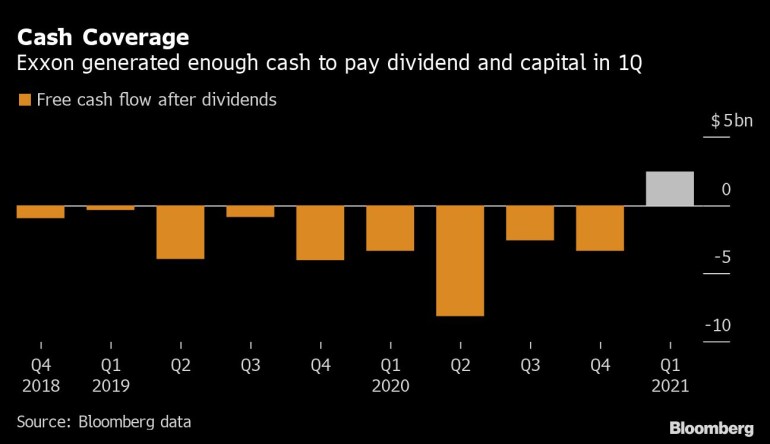

Exxon nearly $ 6 billion in free sales was enough to repay its large share, the first oil giant managed to do so by the end of 2018. DRM sent $ 3.4 billion in the first quarter, enough to pay for the latest installments, which is a careful monitoring measure oil.

For both companies, the main driver in terms of revenue growth was cutting more costs because fewer experiments such as shale drilling were popular with cheaper jobs. Exxon paid more than half as much as DRM down 43% from a year ago. There are no plans to raise money due to rising oil prices, a sign that the sanctions are still in place.

Exxon received 64 cents in the first round, assuming an average of 61 cents for experts in a Bloomberg study. The oil giant exploration and drilling operation carried many advantages but also received a large giant from large pharmaceutical trees that helped eliminate the effects of the February hurricane in Texas.

Exxon’s transition from unprecedented losses last year helps to restore investors’ confidence that they can retain and grow the third largest S&P segment, the cornerstone of Chief Executive Officer Darren Woods to Wall Street. Unlike Shell’s European and BP players, Exxon did not cut payments last year, but the idea came to a head: lending rose 44% to about $ 68 billion. Exxon has reduced debt by about $ 4 billion this quarter.

Chevron recorded a dividend rate of 90 per cent, according to the words, corresponding to expert predictions. Consequences across the region indicate that the worst possible scenario is the result of a global terrorist attack that kills those who want to kill Covid-19.

In the midst of looking good, major challenges remain. U.S. DRM refineries lost money for the third time in four years, while foreign oil production reduced oil-free refills by 16% to offset fuel shortages.

Both companies also reported the effects of a cold storm that hit Texas in mid-October.

DRM wants to start buying shares but has refused to give up, repeating what was announced in March.

“As we look forward, we look forward to starting to redeem shares once we are confident that we can implement a recovery plan for several years through oil prices,” Chief Financial Officer Pierre Breber said in a statement prepared for a meeting with experts later this morning.