Bitcoin expires a week later as China warns of crypto theft | Traffic Companies News

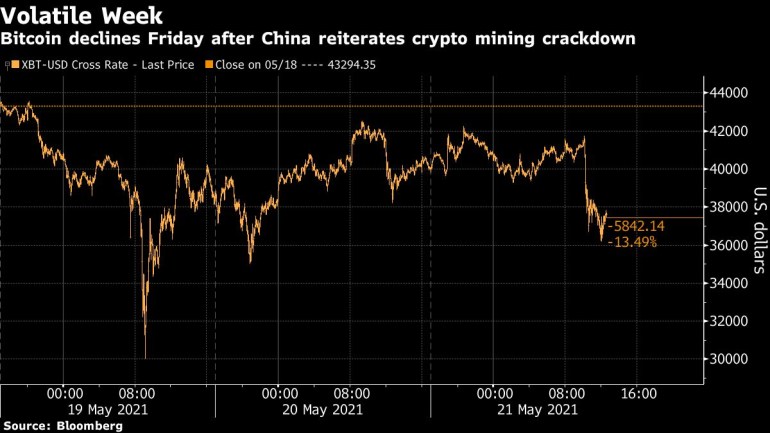

The largest digital currencies fell by about 10% at the end of Friday, to $ 35,636, while other tokens also send losses of two types.

Bitcoin enters its weekend this weekend after a recent warning from Chinese officials to reduce cryptocurrencies.

The largest digital currency fell 10% at the end of Friday to $ 35,636, and peer-to-peer shows also sent two stickers. The fund nearly hit $ 30,000 earlier in the week, after May 14 at $ 49,100.

The latest developments came when China State Council reiterated its decision to reduce Bitcoin mining and trade. The crypto market was shaken earlier this week due to compulsory trading and possible tax revenues in the US.

On Friday the beats of Bitcoin believers continue to rage after their rights activist Elon Musk made a face and protested the brand by using its power. Bitcoin has dropped by about 25% since last Friday, though from Wednesday it has dropped to $ 30,000. More money has dropped – Ether is down 38% over the past seven pages.

The bitter stretch began with Musk suspending Bitcoin payment payments to Tesla Inc. and selling cryptocurrency products and accessories on Twitter. China’s biggest bank added to the downdraft Tuesday with a warning not to spend real money. On Thursday, it appeared the US would demand that $ 10,000 or more be paid to tax officials.

China has expressed dissatisfaction with the uncertainty offered by Bitcoin and other crypto tokens, and has warned in the past that financial institutions are not allowed to accept payments. The country has a large population of crypto miners around the world, who need more energy and thus undermine the country’s efforts to reduce greenhouse gas emissions.

“The new technology offered by regulatory agencies – they are seriously considering it, they want it implemented,” said Bobby Lee, founder and CEO of Ballet Storage Company in a statement on Friday. “There are discussions to follow the miners. The question is, can they work for all the miners. ”

China’s actions this week reflect the country’s unwillingness to manage a group of unknowns. It is something that China would like to see controlled by the People’s Bank of China, market observers say.

“It’s not really the mining issue that’s the problem,” said Matt Maley, market manager for Miller Tabak + Co. “They say they are doing this as a way to reduce risk in their markets, but it is not a sign that China will become a major market for cryptos unless it is run by the PBOC.”

In the meantime, volatility in Bitcoin should remain high. On Friday it also forced Bitcoin at a median price over the past 200 days, which for some charters and experts suggests it could drop to $ 30,000, where it received support earlier this week.

This week’s change has led to a major takeover of investors and tarnished the reputation of cryptocurrencies as the sector grows. Musk’s actions showed that a few tweets could inspire the entire market. But in particular, the last few days have re-established the legal risk in the crypto market.

“Investors are ignoring the risk of setting up crypto currencies while governments are protecting their financial interests,” said Jay Hatfield, chief executive of Infource Capital Advisors in New York. In the US, the possibility of setting standards for corporate disclosure could be a “tip of the iceberg” of legislation that the Treasury may have on the economy, he said.

According to Chinese law, it could be a waiting game for you to watch.

David Tawil, President of ProChain Capital, said: “You have to be careful with China at all times – not to exaggerate or overdo things.” “We need to see what the law says. It’s one thing to say, it’s another thing to do. ”