UK Parliament Launches Legal Process

British lawmakers have set up a system to interrogate “most troubling” questions they ask FinCEN files, a study of global money laundering based on data shared by BuzzFeed News shared with the International Consortium of Investigative Journalists.

The investigation revealed how Western banking giants are raising billions of dollars in suspicious cases, enriching themselves and their allies while supporting terrorist, financial regulators.

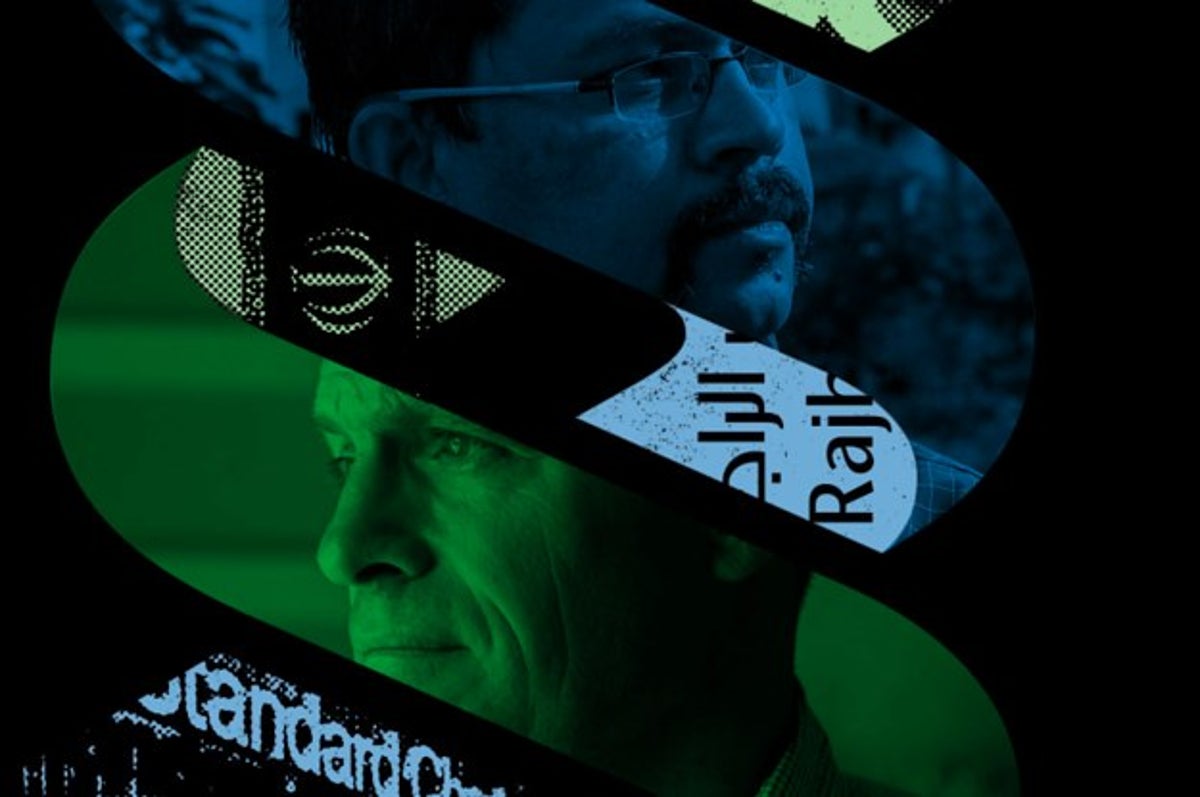

The document contained numerous revelations about Britain’s financial system and some of its major banks, including HSBC, Standard Chartered, and Barclays Stadiums. Thieves often use British terrorist companies to move their money as a result of the company’s design rules. The UK crisis is so severe that a US government secret report says the country is “high risk”Money laundering.

Parliamentary Finance Committee announced the inquiry shortly after midnight on Friday.

Mel Stride, chairman of the committee’s countermeasures, said the inquiry was a review of government and law enforcement agencies’ efforts to curb money laundering.

“It is important that the right institutions are properly monitored and evaluated to ensure that the UK is a clean place to do business,” he wrote in a statement. Questions from the British Parliament gain evidence through written and oral documents, much of which is presented publicly, before the final report.

After a search of the FinCEN Files was first released in September, Stride announced that his findings were “difficult” and sent several questions about this to government agencies. Stride released the responses the agencies wrote Thursday.

The Financial Conduct Authority, which oversees operating banks in the UK, said it had written to all the banks listed at FinCEN’s offices to inquire further, and said it was “suspected of wrongdoing,” said an investigation was launched.

James Brokenshire, the state security minister, wrote in a Stride response Home Office and the National Economic Crime Center “carefully considered their claims” contained in the FinCEN Files to “see what needs to be done.”

The FinCEN Files investigation was compiled by thousands of “suspicious reports” sent by banks to the Financial Crimes Enforcing Network, a US state-owned company charged with money laundering.

Responding to questions about whether FinCEN Files have caused banks to hold less SARs, Brokenshire said law enforcement officials “did not mention anything” in providing suspicious reports. The following week of release, “SARs continued to be sent at, or above, at their normal level.”

Source link