Traders are turning to factors that prevent the collapse of the US market

Advertisers are increasingly touting their defense tool as US stock market fewer jobs in the coming weeks.

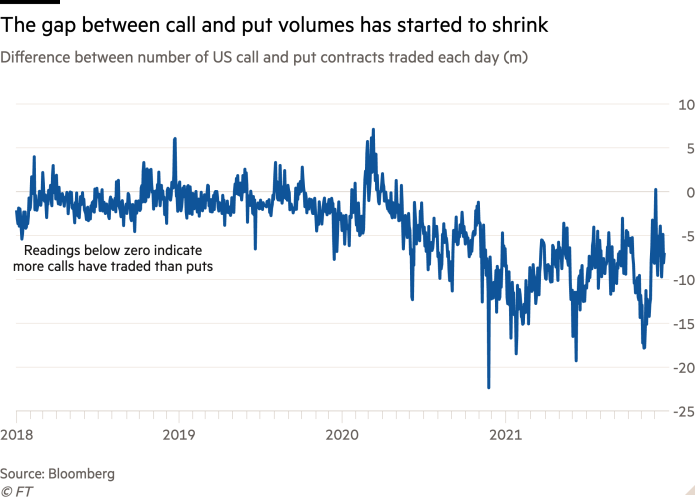

Traders are buying more contracts, hoping that the results will set the bar as stocks fall from stocks. Growth in contract use, combined with the number of new traders entering the markets this year, has been followed by market instability of the $ 53tn US dollar.

Stocks have been slashing last month as traders face the spread of Omicron various coronaviruses, economic policy from the US Federal Reserve with the hope that the White House is a guide $ 1.75tn operating budget may resign from Congress.

This has forced all retailers and organizations to agree on options, which could pay off if security becomes cheaper. That’s a dramatic change, especially among the retailers this year was tireless buyers music options – peripherals that can be profitable if stocks go up in price.

“When you have inflation, record high prices and high interest rates, which makes it easier for people who want to buy extra security,” said Tom Sosnoff, co-founder of Tastyworks, an online marketer with hundreds of thousands. for customers. “Every time you take a picture a lot of people think ‘when the shoe will fall’.”

Although the S&P 500 has improved by 27 percent this year, setting a new record on Monday, the profits have not been shared equally and most investors who came in to buy dips did not receive a reward.

More than 200 US equity companies have dropped by 10 percent from recent performance, and about 90 of the S&P 500 companies have dropped by 20 percent. This has become one of the hallmarks of some entrepreneurs that “anything assembled”Is not as strong as most benchmark indices do.

Much of the meme material that went into the stratosphere has returned to the world, including the recent decline of GameStop and AMC.

“Customers have made tons of money buying phones and fantasies over the last year or two and now it doesn’t work anymore,” said Henry Schwartz, chief of product intelligence at exchange owner Cboe. “How many customers can effectively change the way they can perform in a side or lower market?”

Goldman Sachs analyst Vishal Vivek also said that one of the stocks traded up $ 353bn on December 3 and that the average daily trading volume of $ 233bn in November was very high. Vivek added that the $ 217bn daily price in December remains high “even lower for single phones”.

There are other indications that purchases are from retailers. An increasing number of small businesses, which traders have used as a measure of retail sales, have been making these new contracts. Jason Goepfert of SentimenTrader estimates that about 23 percent of new contractors opened last week on December 17 were contractors, up from 16 percent in early November.

It makes the jobs more relevant to the way entrepreneurs use peripherals in the face of the growth of many stocks this year, where many modern day traders had bets that could climb.

“It’s an innovation that people don’t think the sellers had,” said Peter van Dooijeweert, an electoral expert at hedge fund Man Group. “They think of business as a knee-jerk buyer. But we see that disruption.”

Van Dooijeweert added that it was not the retailers who turned to the options. Big money regulators have also begun to put contractors, using them to secure their positions instead of the Treasury, considering that US government debt has no chance of taking action in the event of a equity market collapse.

The number of successful contractors has risen by 25 percent since the end of 2019, according to a study by Cboe Global Markets and OptionMetrics. And there is a perception that even new retailers are not showing some of their old practices. When buying music options, a group of stockbrokers often opened and closed stock options on the same day, in order to benefit from the volatility of the option price rather than making long-term calls on the management of lower shares.

While this has been true in this regard, experts and traders have said that there are indications that these small businesses are also using traditional norms: keeping blockade of sales.

“This market is killing me,” Reddit user ColdDonkey4784 wrote on the WallStreetBets message board. Talking about how to make a profit – sometimes called “chicken” – through selective trade, the man said: “I am a cow by nature. But I am happy to buy property if they have made a ‘tent’.”

Source link