The reason why central banks no longer agree on how to use inflation

At one point, central bank regulators knew what they needed to do to cope with rising prices. In the face of the economic crisis of the coronavirus epidemic, the relationship between how to promote low prices and stability is strained.

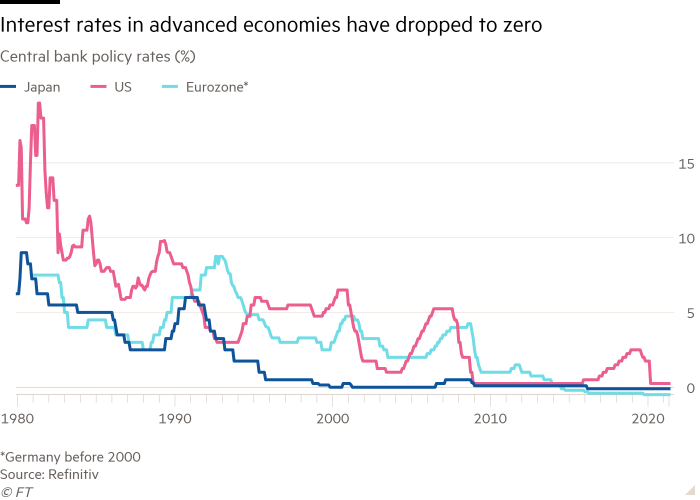

After years of raising interest rates based on forecasts for declining prices and demanding at around 2%, global financial regulators are pursuing various options.

OECD warned this week “caution is needed”, but any attempt to raise interest rates should be “government-sponsored and driven by temporary changes in the labor market, signs of inflationary pressures and changes in economic attitudes” – unpredictable for any central bank to claim .

The US Federal Reserve has done he changed his position In order to provide more opportunities for inflation and employment priorities, the European Central Bank is in a constant state of controversy over whether it should tolerate inflation, and the Bank of Japan is struggling in vain to restore consumer confidence.

Breaking: What’s the New Season?

Prices are rising in many countries. FT checks if inflation has returned.

DAY 1: The development economy has not experienced the downturn in many years. Is this about to change?

DAY TWO: International cooperation between investors on how to promote low inflation and stability has been disrupted.

DAY 3: Canary in US coal mines: used cars.

Day 4: How HIV can affect the rate of inflation.

Day 5: Why inflation in developing countries is a problem for developing nations.

Changes in attitudes in the US have been dramatic; Last year Fed chairman Jay Powell announced the new currency.

The Fed’s belief is to move away from the past decades in order to increase inflation as they work harder, a process that is said to benefit many Americans, including low-income and low-income groups.

This will enable inflation to continue to increase by 2% over the short term, in an effort to ensure that companies and businesses expect interest rates to remain low over the long term and as a result will lose rather than save. One of the Fed’s objectives is to avoid repeating its sentiments in the aftermath of the financial crisis, while tightening the rules delayed recovery.

“I look at the risks on both sides of the path we are hoping for,” he said. Lael Brainard says, Fed ambassador, Tuesday. They monitor the “low cost of prices” to ensure that they do not grow “in unpopular ways” and “monitor the risk of recurring risks”, he said, warning that before the epidemic of “low interest rates”. [and] the decline of the movement “was” self-reliant “on their own

But critics complain that the Fed’s proposal was designed to create a more economically sound economy, not a time of epidemic major borrowing is a waste, and that this could leave them behind the curves as timber prices grow.

Friday a 3.1% annual increase to Expenditure on personal expenses the index reinforced some of those fears.

The BoJ has been committed to promoting economic growth over the past five years, but has not yet reached its 2% target. Surprisingly, little has changed since the plague: inflation is nowhere to be found growth and waste of money are relatively easy.

Japanese families and companies are confident that the economic downturn will remain close to zero, leading to the BoJ not achieving its goal.

“The realization of inflation expectations in Japan has a profound impact not only on the current economic situation but also on past experiences and current events,” BoJ ambassador Haruhiko Kuroda said recently.

So far euro makers are concerned about an angry argument the ECB’s approach to its policy; The results will be announced in September.

Olli Rehn, who sits on the council as governor of Finland’s central bank, recently said: “Given the economic and developmental perspective it makes sense to accept a certain [inflation] excessive shooting, considering the history of ground shooting. ”

But Isabel Schnabel, ECB chief executive, warned that this could be dangerous. Schnabel said last month that even the central bank should not overdo it if the swelling goes up after being lazy, he “doubts” that he is insisting on a temporary price hike.

“How long will the distance be? How much of it should be explained? ”He asked. “I don’t think we should go that way.”

For some economists, the inconsistency is off-limits: the economic downturn has grown so much that bankers are lacking the tools to do more.

Richard Barwell, chief research officer at BNP Paribas Asset Management, said the ECB was “bulletproof” and while inflation in May rose slightly below expectations but below 2%, it could take a financial toll or just a long-term chance to do so. .

“Unless there is a lot of Biden money flowing into the streets of Europe or the hurricane disappears suddenly, the amount of incentives needs to rise in price by more than 2%… More than they can afford,” he said.

That leaves Money alone and a tough choice in the coming months. Rising prices in the US are shooting his target, more people are needed and should decide if they can use the brakes gently.

Proponents of her case have been working to make the actual transcript of this statement available online. Proponents of her case have been working to make the actual transcript of this statement available online. San mfundo ali ali mfundo mfundo mfundo mfundo mfundo mfundo mfundo mfundo mfundo mfundo mfundo mfundo,,,.,,,..

Last week the deputy chairman of the Fed, Randal Quarles, said the plan was designed for a world with “declining labor, declining capacity, declining economy and, consequently, lower interest rates”.

“I don’t mind going back to the 1970s,” he said.

Source link