The pilots are planning to make a difficult trip to get back on long trips

Aircraft manufacturers are worried that the coronavirus could wipe them out and that their jets, pilots and rental units, are on the verge of death. Eighteen months later, riders are back – but mostly on shorter routes.

As the need for riders approaches or compares with the epidemic before short-term trains where small, one-way jets are used, long-distance vehicles remain scarce and large airplanes flying overhead remain useless.

With more than 1,400 jets of these twins stored at the airstrip in early December, according to a Cirium pilot survey, the recovery time in the multicultural market remains uncertain.

Despite declining numbers from the peak of the epidemic in March 2020 when about 3,586 twins were stored, about 30 percent of the fleet is still in existence because flights have been delayed.

It is very different from the pre-epidemic period when some observers report that there were larger planes after ten years of production and heavy cargo.

After the Covid crash, there was “a slight increase in international flight” after “a slight commotion,” said Christian Scherer, chief marketing officer at Airbus.

The epidemic has helped “reduce this” as well as “provide large airlines a little farther away from major airlines and increase the cost of low-cost, low-cost alternatives”, he said.

At this juncture, Boeing and Airbus were keen to push their jets.

There was “a lot of excitement about the Boeing 787 and Airbus A350 [both wide-bodies] bringing a lot of expertise and valuable resources to the market, ”said Kevin Michaels, general manager of Michigan-based AeroDynamic Advisory.

“It was a long time [the past decade] about the dynamic growth of space travel. We grew very fast, and you had a high price for cheap fuel. Putting the two together with new technology is a time of dynamic growth. . . all of this made the conspiracy theorists call for aggression, “he added.

Scherer, however, is “absolutely convinced” of the need for the market to resume two-way jets and “return” as the short-term market or domestic aircraft, international vehicles and other countries have resumed.

But it could be “sometimes between 2023 and 2025 blocking everything” before long trips, he said. It will take a long time for it to return to the production of multi-component aircraft.

Workers in some industries insist on long-term recovery and a multilateral market, but admit that it will be difficult.

Warren East, chief of the UK’s Roll-Royce engine makers, well-known in the multi-unit market, said early December that any recovery. it can’t be of the line, especially based on the Omicron brand. “It will be a matter of 10 steps forward and two steps back,” he said.

Ed Bastian, head of the Delta, quoted East comments, warning that Omicron had managed to reserve books in January, especially for outdoor trips. Immersion is visible “everywhere. . . “States have imposed travel restrictions,” he added.

Ihssane Mounir, deputy vice president of business at Boeing, said “people want to travel” and stressed that the need remains strong over time. However, he admitted that it was “very early in the day” when the 787 producers, who climbed 14 per month in 2019, would get there again.

“We need to build from two to five, then see how it goes,” he said.

Scherer’s theory that the recovery of whole-body jets will last for at least a decade, at least, is shared by independent experts.

“I believe the prices for new bodies will not return to the epidemic before, for many years,” said Scott Hamilton, a spokesman for Leeham News.

Michaels of AeroDynamic agreed, saying it could be by 2030 before the 787 prices created by the twins hit 2019 peak 14 per month.

For larger jets, four-engine aircraft, the market “is about to end,” said Rob Morris, chief consultant at Ascend by Cirium. “Most of them are either divorced or evicted.”

There are green shoots, however, of the new two-engine jets, according to John Plueger, chief of Air Lease, one of the largest aircraft carriers in the world. “We are seeing a gradual increase in the need for new generations, but it is not as strong as one approach.”

The need for cargo is one of a growing number of factors, he said, as airlines use passenger planes to try to raise more money for cargo and freight.

Predicting the requirements, however, has been difficult due to Boeing’s manufacturing problems with the 787 Dreamliner where it is difficult to fix the problems. American Airlines says it needs to update its summer schedule because the promised 787s had not yet arrived.

Plueger, a Dreamliner customer who canceled three orders for the incident, appeared frustrated with the delay, saying: “We as a company cannot be in place. . . while one of the airframe manufacturers cannot produce one of its main features. . . These companies need these aircraft and we are looking for two strong competitors in Boeing and Airbus. “

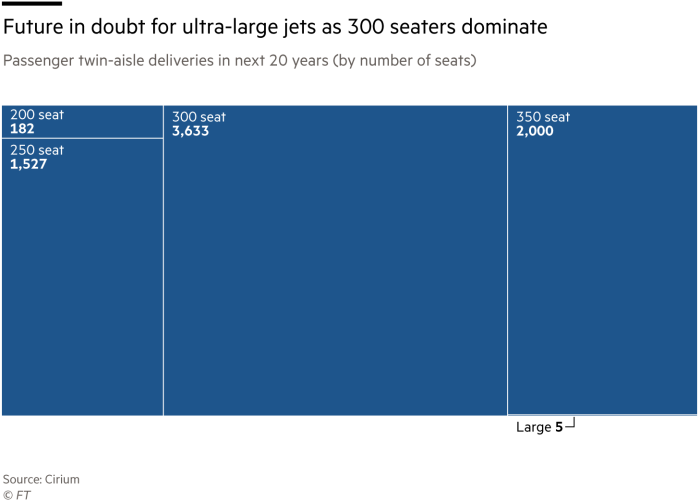

Boeing also has a big bet on resuming global flight with its next international brand, 777X. Offered in two models, 777-8 and 777-9, which can carry 426 passengers on long distances, is the largest when the Airbus A380 has stopped production. 777 has started testing, but is running two years back.

Some observers have suggested that it would be large enough to attract the attention of the affected audience.

“777-9 is the largest for most aircraft – with the next A380 and 747 based on the wrong size in today’s market,” said Hamilton, of Leeham News.

Some, however, think that people should not count the 777-900 jets wide-body jets. Michaels said Boeing will find customers among the major airlines in the Middle East. Expecting Boeing to come out with a cargo 777X.

The 777X will be the largest aircraft in the market as carriers begin to upgrade their larger aircraft in 2025 and 2026, says Boeing’s Mounir. With more than 300 orders for the flight already, “it’s time to come”, he added.

Despite the uncertainty over the timing of the recurrence of the multilateral market, there is a clear picture of the industry: the need to repatriate one-way flights, as airlines are calling for repairs to their ships after a crisis.

Airbus’ Scherer said demands remained strong despite the rise of the new Omicron model. Air traffic controllers, he said, have realized that “once people go, they move and they will have to take revenge”.

Source link