Why are Wall Street fears so low?

After fearing a sharp rise in prices in the first few months of 2021, markets have changed in another way: sleep deprivation.

Vix, a measure of the expected instability in Wall Street’s S&P 500 equity index, declined until the flu season dropped by 15.7 points on Friday, after rising above 80 in the early stages of the epidemic. Uncertainty in foreign markets by Deutsche Bank has also fallen sharply since February 2020 last week.

The analysts say the timing is a clear indication of the Federal Reserve’s wait-and-see approach, which is geared towards curbing inflation without withdrawals, whose departure could disrupt markets. But some traders are afraid that neglect is on the rise.

“We are” very aware “of the stability in the stock market, says Gergely Majoros, a member of Carmignac’s European fund manager. “That means you have to be vigilant to know what’s coming in the future.”

In a study, Swiss bank Credit Suisse’s financial committee also warned of a “significant increase in investors” in the stock market, pointing out that there is a “greater risk to media coverage than ever before”.

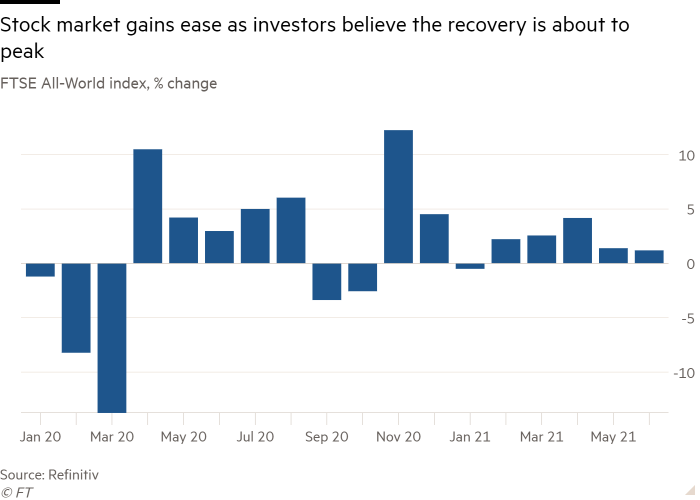

Global stocks have come to the forefront of the economies of developing countries’ rapid recovery from coronavirus, which increases industry confidence. But these benefits have changed in recent weeks, with some investors saying the good news has already been made known. The upcoming FTSE All World market for the upcoming stock market has benefited slightly by a half per cent so far this month.

Rising inflation in the US hit 5% in the 12 months to May, following a 4.2 percent an increase in April when prices are tied to the economy and reopened by barriers – such as retail cars – he grew up.

Central banks have traditionally set the economy in place to deal with rising inflation. But the Fed, which is meeting this week, has retained inflation temporarily. It has also made many depositors convinced of this.

“The market is connected, perhaps in the meantime, with [Fed chair Jay] According to Powell, the inflation we are seeing is short-lived, “said Margaret Vitrano, a history manager at ClearBridge Investments.

A Bank of America survey of 207 global managers looking at $ 645bn on consumer goods this week has shown that more than seven in 10 believe a strong outbreak of the epidemic could be temporary. Many have already blessed anticipation funds in anticipation of Fed support in the market in the future, and have taken part in construction in stadiums for up to three years. The negative stereotype of connectivity is another factor that has persuaded property managers to keep spending money, say businessmen.

“Costs should also go up this year but not at the same rate as the pace of work at the beginning of the year,” said Caroline Simmons, UK’s chief financial officer at UBS.

Low volatility is not a constant indicator of selling stocks, according to history. Statistics compiled by Schroders researcher Duncan Lamont showed that, starting in 1991, buying S&P 500 on the day Vix was between 15 and 16 would lead to a full recovery of 14.6% over the next 12 months.

But calm sentiment in the markets indicates dissatisfaction that could be disrupted, analysts said, if inflation exceeded Fed demands.

“If inflation persists, it means inflation that companies cannot pass up. . . because food and household energy are so high that it also affects profits, ”says Vitrano of ClearBridge. The stock market was “treading water,” he said, “because it’s too soon to order this”.

The stock market has also been damaged by the prospect of long-term savings on the economy than expected by traders.

The dollar, which measures the strength of the US greenback against its shareholders, has moved less than 1% this year, strengthened in the first quarter and yielding more of its profits since then.

“The great issue of inertia in [currencies] it is very straightforward, and emphasizes the balance between the unwavering power of the United States and the immutability of the very sick Fed, ”said Paul Meggyesi, chief of FX’s global channel at JPMorgan.

The General Assembly predicts that the US economy will grow at an annual rate of 9% in the second half of this year, a review later. Corporate profits are expected to follow suit.

Researchers predict that profits for companies listed on the S&P 500 will increase by 35% this year, dropping a profit of 12% by 2022, according to FactSet. At the Stoxx Europe 600, profits are expected to increase 51% this year and 14% in 2022.

“The only way the Fed and other central banks can take this step is to reduce housing, and this could lead to a disruption of the partnership,” said rising yields, says Olivier Marciot, treasurer at Unigestion. “The market is waiting, not for what is next but for when. . . If you move too fast in the game you will be beaten. ”

Source link