Fixed: Stock prices and cash flows

This article is on our page of incomplete mail. Enter Pano for this letter to be sent to email every week

It’s the end of the first week of Unhedged. How is it going? Send an email: Robert.Armstrong@ft.com.

QE and stock prices (part 2)

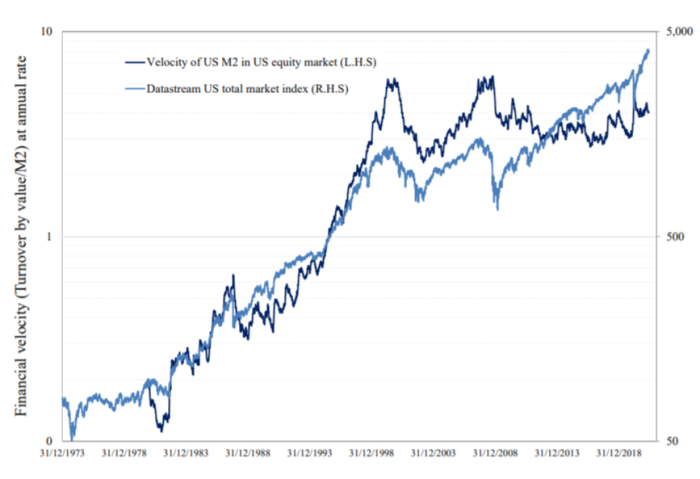

Here are two lines that go up to the right:

The two lines are the M2 currency (currency, deposits, market accounts) and the S&P 500. The M2 is rising sharply due to the reduction in volume: The currency is buying savings, thus investing new currency there. The reason why the S&P is rising so fast is not clear. Seeing that the two lines have moved recently reaffirms a well-known story: “Money is printing money, and it has to go elsewhere, and go to the stock market.” A few days ago I he realized that these articles are wrong, because money is not converted into stock. When I buy shares, the seller earns money. It is not a “marketplace”.

What is really happening is that all the additional costs that make people want less, compared to stocks, and the significant amount of shares that share prices go up. This is how QE affects stock prices (or one way, some people, especially central banks, are interested in the news of QE lower discount prices, which will soon occur.)

Eric Barthalon, global market research leader at Allianz Research, says the approach is self-limiting. When the price of a commodity rises, the weight of the investment compared with what is available in the financial sector drops to a level where the investors are happy. Advertisers stop selling so much, and prices stabilize. In this case, it is not just Money that fills the markets with money. There is a middle ground: the love of money for investors.

Barthalon’s argument – I see it as convincing – is that (a) money lovers are unstable and (b) Money is not improving over time, so markets are falling. You can follow the instability of saving money by looking at cash flow, or how they change hands. Barthalon told me:

“It is not the amount of money but the spread that causes commodity prices to rise or fall. . . and experience shows that major banks do not restrict the flow of money, especially in corporate markets. ”

Now we have seen why central banks would opt for the concept of QE, controlling interest rates that justify the value of stocks, while keeping yields at low levels of government. Because the eagle, in theory, will work even if women think they want more money – which they do when markets fall.

Here is Barthalon’s long-term chart of the exchange rate in the stock market (daily stock price shared by M2) against the stock market price. See how fast the market is working hard:

The two lines are different, and they correspond to the white matter. The result is that the amount of floating money cannot, on its own, save the stock market.

Armstrong’s Dept is wrong: bitcoin

Yesterday I said that bitcoin is well regarded as a justice for a company whose only assets are unconfirmed technology. This technology is guaranteed when bitcoin becomes a currency. But bitcoin is not a currency now because, even though people sell it, it is not accepted as a payment method, there are few instances in it, the purchase price is higher, and much more.

The most common response I received was that bitcoin is not trying to be a currency. Money has two main advantages. It is a place of trade and exchange. Most of the people who think I’m wrong think that bitcoin is a for-profit. That is why its essential presence is so important. If it’s cheap to sell, a little liquid, and so on – who cares. Similar to gold and diamonds, the materials whose properties are rare and their quantity, they are easy to use.

I am not satisfied. Gold and diamonds have been used in companies and gemstones, having thousands of years in conventions to support their value. The only thing that supports bitcoin as a valuable store, as a commodity, is that it can be a valuable asset and especially Good exchanges – which can be exchanged highly, without controversy, at a low cost, and (here is the real key) without the control of a third party or regulatory authority. And I don’t think we still know that this is so. Bitcoin is a necessity, as well as watercolors that I wrote in high school. This does not make them a storage area.

Also, the heads of bitcoin should register #fintechFT, our newsletter on the technical and economic intersection. Dinani Pano.

Read it carefully

I was touched this Bloomberg’s US demand for housing is so strong that homeowners are moving away from fixed prices, creating eye markets to secure the lowest prices:

“Clashes of gangs [is] storing new equipment when it is most needed. Buyers are pushing for new homes because remote jobs increase employment, while rising prices and a shortage of labor are hampering construction work. ”

This analysis suggests that there are no 2007 hypothetical hypotheses in the mix. This makes me crazy. Isn’t that just a fad today? Why not live in a house? I don’t know if there is any evidence, but I’m looking. If you have an email, send me an email.

Source link