Divide the price ‘pop’ in US IPOs falls by half

Investors are no longer using it to fund their initial US offerings, reducing the chances of the company buying their shares more than they expect or enjoying a larger “pop” share on their first day of trading.

The latest figures show that the IPO market has stabilized significantly since the first red quarter, as shares in floating companies have recently gone down and other high-profile debuts have arrived.

In January and February, shares of companies affiliated with the New York Stock Exchange or Nasdaq rose nearly 40% from their IPO price on the first day of trading, according to Dealogic.

In March and April, ordinary pop had dropped by nearly 20%, and in May it dropped again by 18% from mid-last week. Most do not include the IPOs of spacecraft companies (Spacs), which are about to dry up after overseeing regulators in the market.

Many companies are still on the rise in their market, but in the last few weeks more people entering the market have gone down on their first day of trading. China’s Waterdrop technical team fell 19% for the first time, while Vaccitech, a company with Oxford / AstraZeneca coronavirus vaccine, lost 17%. Biotech Talaris Therapeutics fell 4.4 percent in early May.

“It’s not that ‘everyone’s market is as successful’ as it was in the first quarter,” says Rachel Phillips, a business partner at Ropes & Gray.

Prices in IPO itself have been tough, too.

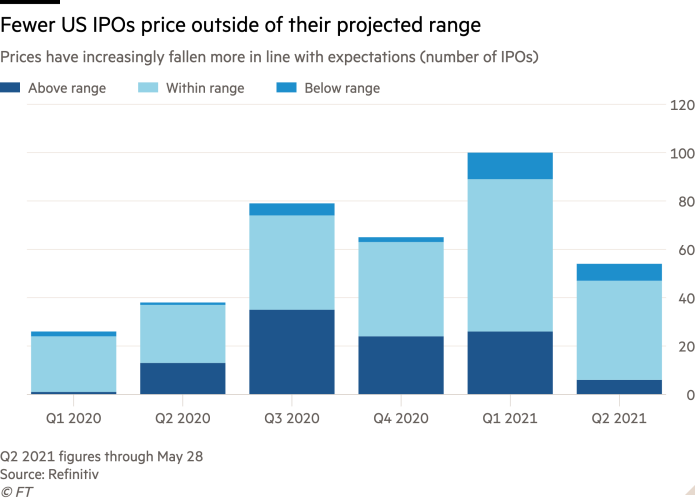

In the first quarter, one in four companies that go public in the US IPO prices are higher than expected, according to a Refinitiv find. The fourth quarter of last year was very hot, while about 40% managed to beat their teams.

Since the second quarter, the proportion of companies exceeding their expectations has dropped to 11%, according to Refinitiv. Thirty-three are at a relatively low cost – the largest portion since the beginning of the epidemic.

“There was an amazing market” earlier this year, says Jeff Bunzel, chief marketing officer at Deutsche Bank. In January, any US IPO technology has bought the top of its range, he said. Now, “there are many places for the market to return[but]. . . it is not that the IPO market is broken or deteriorating ”.

With one month to go in the second quarter, 54 companies have earned $ 18bn so far. Of the top 101 companies, with the exception of Spacs, they earned $ 42bn, the highest quarters of an IPO after the plague, according to Refinitiv.

Advertisers continued to insist on choosing IPOs.

Hospital-type figs, which joined the New York Stock Exchange on Thursday, bought its IPO for $ 22 – $ 3 higher – and added 36% on its first trading day. The company’s stock rose another 14% on Friday.

“Regardless of where the market is, it was our time,” says Heather Hasson, founder of the company.

Some have been hit hard by the stock market, with three companies citing a volatile trading market in May for their decision to delay IPOs.

“That’s the problem, when you make an IPO, you get low in the market,” said Tom McInerney, a senior at Genworth Financial, who wants to restructure his insurance business to return Enact in IPO in mid-May. While concerns about price competition and inflation caused shares in the company to fall by more than 10%, the company decided to delay the IPO at the end.

“We see it as. . . woe is me, ”McInerney said.

Source link