About a quarter of US officials were economically disadvantaged last year | Business and Financial Issues

A report by the U.S. Federal Reserve on U.S. family finances in 2020 found that nearly a quarter of U.S. seniors will be in financial trouble compared to last year.

A large proportion of older people in the United States say the economic crisis is increasing in 2020 than in previous years, the Federal Reserve said Monday, when the undocumented coronavirus epidemic ended the year with even more economies.

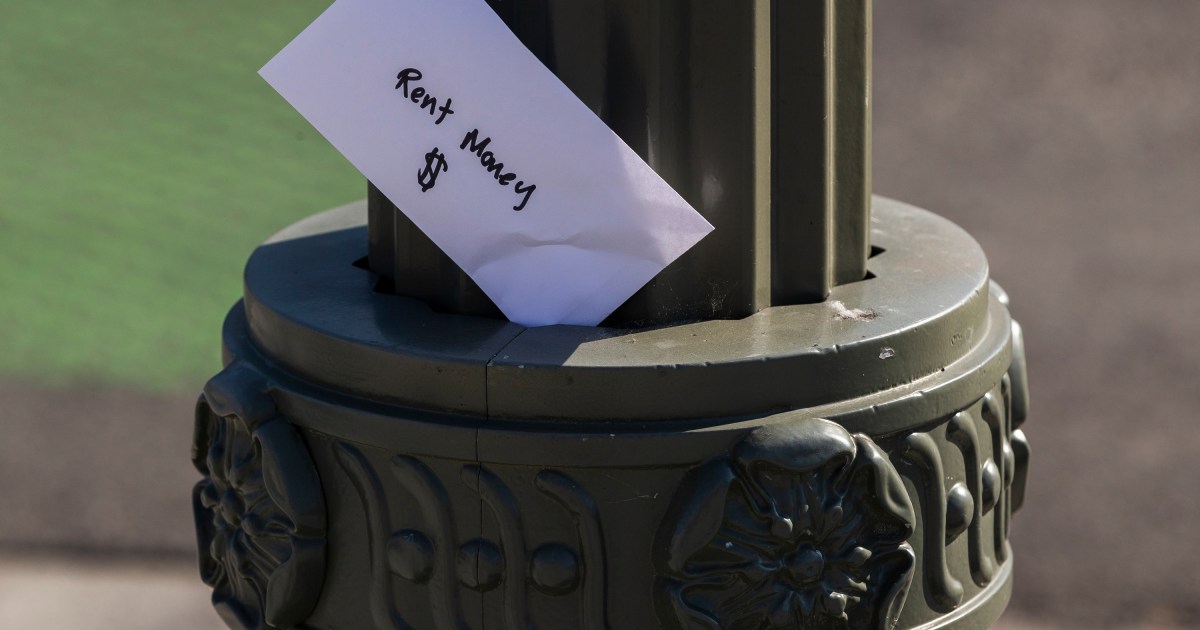

A Fed report on The Economic Well-Being of US Households in 2020 found that nearly a quarter of U.S. adults are said to be suffering more economically than last year – the largest share since the survey began in 2014.

And not all groups experience the same pain as the plague to promote short-term inequality, largely because of race and education.

“The clear impression from this study is that the financial crisis in 2020 was inconsistent, and often left those who entered the year with very few exceptions,” the report said.

For example, the percentage between the bachelor’s degree students who reported doing well last year and those who did not go to high school was 44 percent – ten percent higher than in 2019.

Less than two-thirds of African-American and Latino seniors report doing well economically last year, compared to 80% of whites and 84% of Asians. And the gap in economic stability between older whites and blacks and adults in Latino has grown by four percent since 2017.

Well-educated Americans were more likely to be among those who saw their bank and mortgage rates rise last year, while those who did not attend high school could be counted among those who reported lower bankruptcy.

Job responsibilities also grew. People who kept their jobs during the epidemic became unstable or money changers last year, while those who lost their jobs or lost their jobs – a group that encourages low-income Americans before the epidemic – saw their health finances plummet in 2020.

Of the laid-off workers, about 45% were unable to pay off their debts last November or it would have been difficult for them to face an unexpected $ 400 salary. Latino, as well as those with a high school degree or lower, said the report.

“Even though the economy is doing well, we can see that some are still suffering, especially those who have lost their jobs and those who are not well educated, many of whom are left behind,” Federal Reserve Board Governor Michelle W Bowman said in a statement on the Fed’s website.

Increased demand for children from remote schools and the closure of childcare centers have a direct impact on the economy of the American people.

About 22% of parents also said they were either unemployed or underemployed due to the disruption of COVID-19 – a group that could include African-American, Latino women and single women and low-income women.

Compared to the recent trend, 59 percent of parents with children in K-12 school say their children did not learn as much from a school as they could in a classroom.

The report focuses on an eight-year study by the Federal Reserve Board of Household Economics and Decisionmaking (SHED) that surveyed 11,000 adults in November last year – eight months after the epidemic.