The US is investigating a history report that shows that billions do not pay taxes in the first place

U.S. tax authorities have launched an investigation into the multi-billion dollar embezzlement scandal involving Warren Buffett, Jeff Bezos, Mike Bloomberg and Elon Musk. tax as their wealth proved to be.

Proponents published details of what he called the “most comprehensive information of the Internal Revenue Service” concerning over 15 years of taxes from thousands of wealthy Americans. The nonprofit media outlet did not disclose the source.

The report found that tax evasion measures allowed the 25 richest people in the United States to pay $ 13.6bn in state taxes over the next five years to 2018, although rising wealth, assets and other assets increased their total wealth by about $ 401bn.

Charles Rettig, superintendent IRS The commissioner, however, told the Senate finance committee hearing that the agency had opened an investigation to find out the passage. He also said he shared “concerns of every American” that secret secrets had been revealed.

Jen Psaki, a White House press secretary, said “any illegal disclosure of government secrets by a potential holder” is “illegal” and “in-depth”. She added that the IRS had reported the loss to Treasurer’s chief executive officer. tax, FBI, and US attorney general’s office in the District of Columbia.

However, Psaki added that the loss also meant that “there is still much to be done for corporations and individuals to pay their fair share of taxes” as President Joe Biden said.

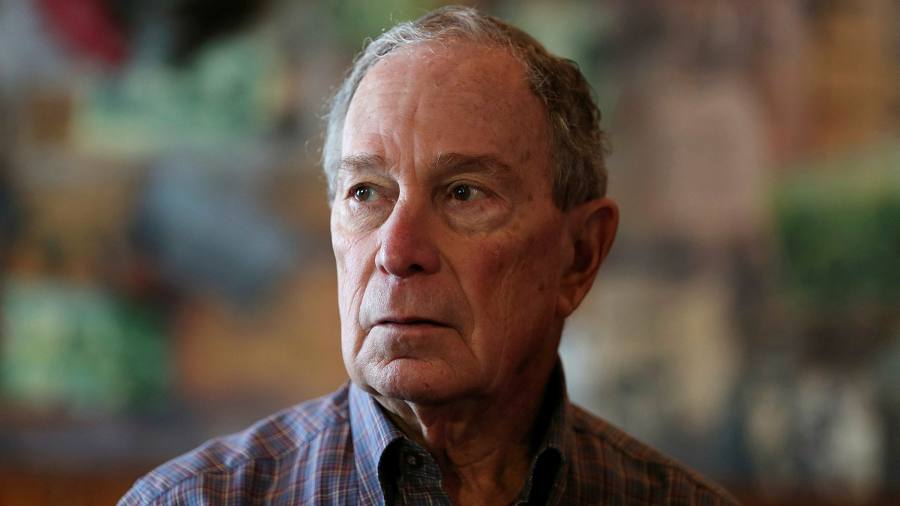

Bloomberg, a former New York mayor and US ambassador to the United States, has vowed to use “all legal means” to determine his whereabouts. The founder of the Financial Advocacy Group pushed aside the views of the case, saying he “carefully obeys the text and the meaning of the law” and allocates about a quarter of its annual tax revenue and charitable contributions.

“The issuance of taxes by a citizen of the state should raise privacy concerns regardless of political or tax sentiment,” he said in a statement. “We want to use every legal means we have to determine who or what government has disclosed this and make sure they are responsible.”

Exit comes as some Democrats do promoting taxation on the vast majority of the American economy, instead of just looking at the annual income that can be recouped by discounts, loans and financial losses.

Elizabeth Warren, a U.S. senator from Massachusetts, passed a law later this year to impose a 2% tax on people with a net worth of more than $ 50m, plus an increase of 1% on any net worth of more than $ 1bn. President Joe Biden said will increase on payroll taxes and benefits for those earning more than $ 1m but did not support income tax.

Warren quoted the ProPublica report, and wrote on Twitter that it showed that it was time to “make the overweight get paid their fair share”.

Morris Pearl, chairman of the Patriotic Millionaires, said the report reinforced his view that the more affluent Americans “can decide whether to pay taxes or not”.

Financial taxes and high taxes on unprofitable earnings that his organization promotes were “nonsense” when it was introduced in 2010, he said, but the idea had completely changed and what ProPublica revealed could boost support.

Bloomberg and Buffett have been among the billions of people who want the richest Americans to pay their taxes for several years, but the economic divisions revealed by the epidemic have boosted politics.

ProPublica said it had decided to disclose the details “because it’s just a fact that people can understand the real tax situation in the country”.

Ron Wyden, A Democrat from Oregon who heads the Senate finance committee, said a ProPublica report showed that “the richest people in the country, who had made huge profits during the epidemic, did not contribute their share”.

Marine Records

Rana Foroohar and Edward Luce discuss major topics in the financial and power struggle in U.S. politics every Monday and Friday. Enter a newsletter Pano

Source link