The uncertainty of Omicron and the US economic system is affecting global markets

Financial markets have been hitting the past week, with Omicron coronavirus globalization as the Federal Reserve demonstrated its willingness to accelerate US policy reforms.

The dramatic changes in global markets have cost billions of dollars to change slightly later – changes that determine how investors should deal with the global financial crisis.

Strong instability confirms how investors are encouraging themselves to start a return to the Fed a very encouraging program, which has helped keep stocks very high. A new strain of coronavirus has raised the risk in a year when investors have thrown billions of dollars into compliance.

“Uncertainty leads to instability, which can lead to people living far away,” said Katie Koch, chief executive officer at Goldman Sachs Asset Management. “We have markets that have very low prices and have a lot of good low-cost stories, so if the news changes too much it could be confusing.”

Merchants and property managers are attracted to changes from Fed, which in November began to reintroduce measures designed to stabilize markets in the depths of the coronavirus crisis last year.

The spread of the new Omicron coronavirus has threatened to undermine the Fed’s recovery, which could jeopardize the economic recovery that gave confidence to the US central bank to launch its own anti-terrorism program as it focuses more on the heat threat. rising prices.

Fed Chairman Jay Powell this week reiterated his commitment to continue reduce speed on a $ 120bn monthly banking program, a process that began last month. He also said that rising inflation could also lead to a slowdown in inflation.

This back and forth, as well as news reports that give conflicting opinions on both the effectiveness of existing vaccines against the Omicron coronavirus and the risks of the virus caused by the virus, it provided oil for profit and significant losses in US markets.

Advertisers are left to fend for themselves, with growing economic growth – caused by market instability – colliding with fears that the spread of Omicron stocks could slow economic growth, especially a way to reduce monetary policy.

“The Fed’s actions, the policies and the actions of the economy, are all in line with the notion that instability will increase,” said Matt Freund, chief financial officer at Calamos Investments.

This week’s economic turmoil has risen sharply since February, and volatility of the $ 22tn Treasury stock market – the backbone of the global financial system – has now risen sharply since March 2020.

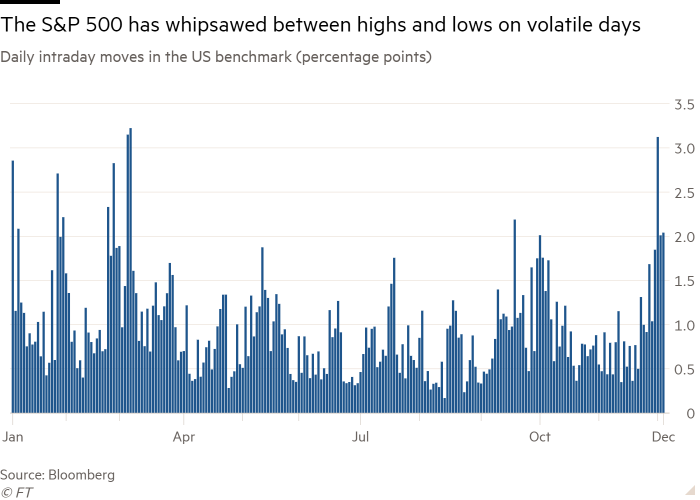

Benchmark S&P 500 US stock index Wednesday recorded a sharp rise in prices since March, with the stock market crashing after a year. And daily moves have been very strong: for three consecutive thirds of sales, the S&P 500 has moved 2 percent or more between its highest and lowest daily levels, a list that has not happened throughout the year.

Although the US has been in the midst of a recent market turmoil, instability has been growing in Europe. The expected volatility in the 50 eurozone blue-chip stocks on Friday last week reached its highest level in one year and has remained high. Similar symbols for Hong Kong’s Hang Seng index and Tokyo’s Nikkei 225 have also risen.

In addition to the financial uncertainty, investors are also struggling to cope with the financial crisis over the holiday season between Thanksgiving in the US and Christmas.

It is often the year of the year marked by the increase in sales and suspicions among fund managers to make the most of the bet, instead of simply putting the risk on the table and keeping profits by the end of the year.

“Most people do not want to do business right now [of the year] and volumes can be low, which can exacerbate instability and increase the size of the movement, “said Jason Hedberg, UBS global marketing chief.

Greg Boutle, a BNP Paribas academic, also added that the instability increase was probably self-feeding, as hedge-related investments that simply change their shape could reduce responsibilities. It is a sale that can lead to a decline.

Investors also said their big business partners had raised prices to make big business, as they moved to protect themselves from any problem if volatility was high and markets went down.

Likewise, some investors protect their businesses – or actual betting – from tail risk, or unexpected but potentially catastrophic events that could make the stock market falter.

John Brady, chief executive officer at RJ O’Brien, said the volatility of stock markets had also helped because the Fed’s tensions, which supported inflation, had begun to be removed.

This was demonstrated on Friday, as foreign markets re-enacted. Advertisers who sell over 26m set options – deals that can pay off if the security price drops. It was the second-highest rate, just days before February 2020 when global financial markets began to be hit by the coronavirus.

Some, like Goldman’s Koch, say they are using dislocations to change portfolios, because some of the smaller ones appear to be depleted.

This difference between fund managers means that as the last few business days of the year go by, investors are preparing for the upcoming crisis.

For John Leonard, chief financial officer at Macquarie Asset Management, the market change is reminiscent of what happened three years ago, when Christmas sale broken goods.

“It is a natural consequence of the combined events of the Omicron and Powell pivot genres,” he said. “The combination of the two has created instability. You will have to wait for the dust to settle.”

Additional reports of Madison Darbyshire in New York

Unhedged – Markets, money and strong ideas

Robert Armstrong shares what is most important in the market and discusses how well Wall Street positive ideas respond. Enter Pano so that the letter can be sent to your inbox every day of the week

Source link