The hedge fund that beat ExxonMobil says it should cut fuel

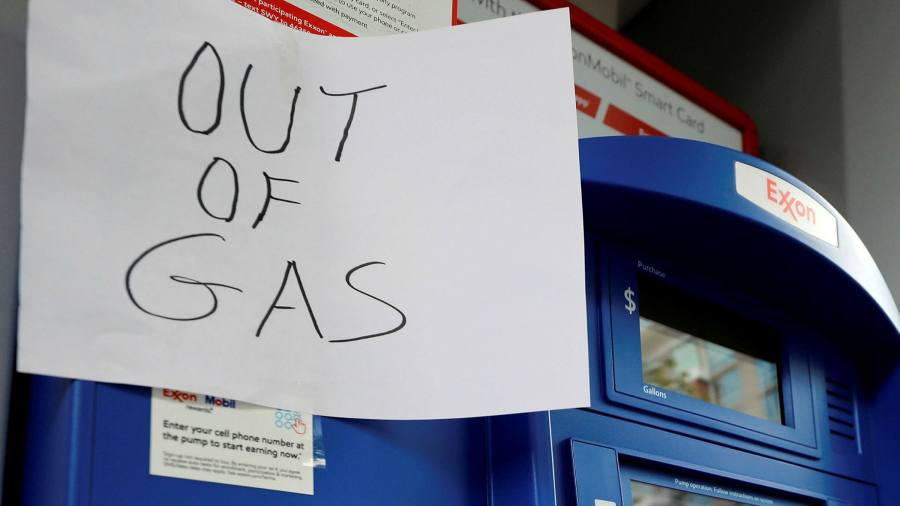

Investors who are at risk of climate change are winning amazing success against ExxonMobil this week said the supermajor will need to cut fuel, indicating that it will continue to pressure regulators to change course in response to a shareholder vote.

“They have to set themselves up for success,” said Charlie Penner, who runs a hedge fund Engine No. 1 campaign against the company. “You would believe that this would help to reduce oil and gas shortages.”

Engine 1, named after the San Francisco fire department, launched a campaign in December, appointing four supervisors to the Exxon board and warning them of “potential dangers” due to their commitment to fuel.

The chutzpah exhibition featured a houseboat launched last year against the world’s most famous oil company, featuring major exhibitions and economics.

One of Wall Street’s very expensive proxy attacks reached its climax at the third annual conference on Wednesday, when ExxonMobil tested what critics described as a theater company, delaying the closure of the vote when it took a one-hour break before CEO Darren Woods questioned questions about the company’s performance.

It was the first time Exxon had participated in a street vote against them.

“Like most of the things we saw at the conference, the way they contributed to the conference was under the auspices of a well-known company,” Chris James, founder of 1st Engine, said in an interview with Financial Times.

“Watching yesterday’s conference is a great example of how they do not realize that the world has changed. It was all shown. ”

Finally, Exxon has announced that shareholders have been involved elected Two Engine Engine No. 1 were selected after the initial count. The bill expects one-third of the vote to be announced when all votes are in place, possibly by the middle of next week.

Engine No. 1 does not monitor the performance of controllers, Penner said. Some analysts say that Exxon executives may ignore new fund managers.

“I can’t agree,” he said.

BlackRock and Vanguard, which own large shares in Exxon, both supported the directors appointed by Engine No. 1 – criticizing the company’s management that environmentalists will announce Wall Street’s new climate-sensitive climate.

But Engine No. 1 was clear that his campaign was about Exxon financial mismanagement in recent years as is the case with the weather.

“Exxon thought this was rational,” James said. But Engine No 1 was a “capitalist group, definitely not a non-profit”, he added. “Our idea was that this would have a positive impact on the share price,” he said.

The hedge package does not require Exxon to repeat the type of migration to the increased power that BP has produced.

“BP spent $ 1 billion to buy half of Equinor’s wind farm, it’s not a very good business and it’s punished in the market,” Penner said, referring to the UK’s oil giant. recent agreement and a Norwegian company.

Penner said Engine No. 1 would give Exxon time to develop a new system – but once the world moves to reduce emissions, the changes are still huge. The change in power that is happening faster than expected disrupted Exxon’s perception of the temporary need for its fuel, Penner said.

“What we are saying is this: prepare for a world where the world may not want you [oil] barrels, ”he said.

It could be the departure of a company currently producing oil and gas at about 4m barrels per day, or more than 4 percent of the world’s population, and has developed long-term plans for new trivialities. use oil in the US and on the coast of Guyana.

Exxon said it is “welcoming new developers” and “will share our plans and listen to their ideas”.

The success of Engine No. 1 has led to the claim that a new generation of enthusiastic sharing enthusiasts must have begun. The investment is worth about $ 50m in a $ 250bn company that less than a decade ago was the largest in the world in the stock market. Other companies see him.

“Our ambitions are more real than Exxon,” said James.

Letter of mail twice a week

Energy is the most important business in the world and Source Source is his story. Every Tuesday and Thursday, directly in your email, Energy Source brings you important news, future analysis and in-depth insight. Sign in here.

Source link