The black market begins, one year after the GameStop turmoil

This time last year, millions of amateur investor jumped into the danger zone of US financial markets in search of wealth, shooting sections in GameStop’s oppressed vendors 100 thousand upgrades and left professional fund managers in awe.

Now big and small investors are placing a bet that means that the fantasy curve is worrying. The Federal Reserve returns from a stimulus program that has kept the markets afloat for almost two years.

Prices for meme stocks, cryptocurrencies, cannabis companies and empty vehicles known as Spacs have all dropped as the air escapes from the masses that sparked the angry meeting, leaving little doubt that the game has changed.

“Money is not in the business of recovering high prices or crypto or Spacs,” said John Leonard, chief legal officer at Macquarie Asset Management. “Stages of hypergrowth for a long time were removed and shot.”

The average price of Russell 3000, which is a major US equities market, has fallen nearly 35 percent from its highest level in the last 12 months, according to a study by the Financial Times.

In the Nasdaq Composite, where there are many fast-growing companies that were known during the epidemic, the median decline is close to 45 percent.

Russ Koesterich, BlackRock’s history manager, said the fantasy had been fueled by “high-income areas” since the coronavirus began.

As the epidemic devastated regions around the world and sent markets to the economy, the central bank and the US government intervened, putting billions into the economy to solve the economic crisis.

“This was very difficult for all sorts of risk factors: it was Spacs, it was IPOs, it was cryptocurrencies,” Koesterich said. “You’ve seen the backlash of all of them recently and I don’t think they disagree. The Fed has made it clear that it wants to reinstate. The extent of it is unknown, but the fact is that you will not have the same support as we did.”

Market turmoil was evident even before the Omicron coronavirus was declared a worm in late November when it spread worldwide.

Shares of technology companies suffered after the initial growth of last January and February. But in October and November they also paid more, hitting their peak rates in the eight months on November 9, the day Rivian’s electric car soared its first price, according to Goldman Sachs index. One day later the price of bitcoin rose to $ 69,000.

The excitement was short-lived. When Rivian Market the price went up for several days with a brief overview of Volkswagen, increased inflation Fed and Investments. Markets began to shift to new realities when lower interest rates and simplified terms were reassured.

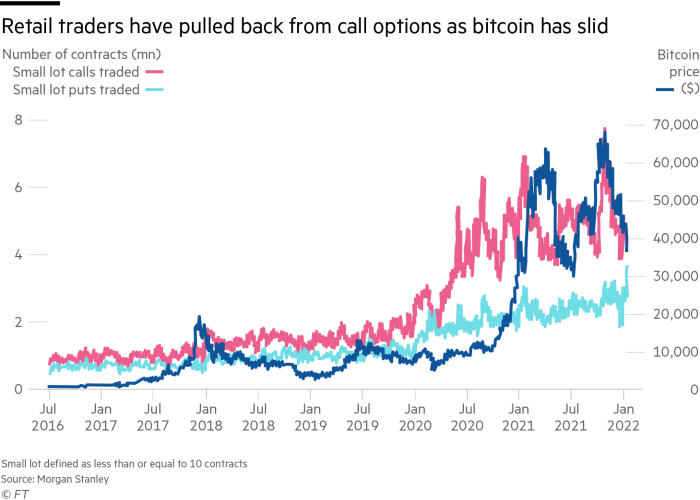

Formerly airlines include Virgin Galactic, DraftKings sports betting sites and plant breeders. Beyond All the animals fell more than one-third between the beginning of November and the end of the year. Bitcoin, which many investors now see as a catalyst for speculative thinking, has plummeted, sometimes falling in value from its November peak.

Ryan Jacob, a technical economist who runs the Jacob Internet Fund and a technology-based ETF, said the crypto market was “similar to what happened in the dotcom boom”, while many investors believed the new technology was viable but found it. it is difficult to know which businesses to start.

“There have been big companies coming out of this, but that’s the easy part,” he said. “The hard part is finding that. 90% of companies can be all waste.”

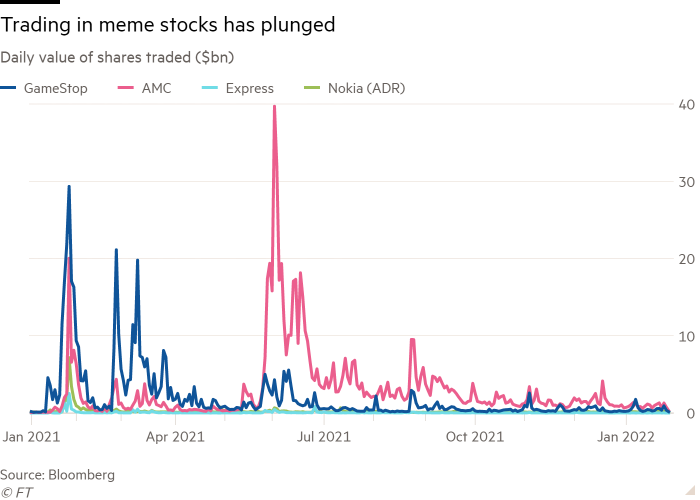

For companies at risk of meme stock frenzy, fluctuations have been extremely violent. The share of GameStop video game vendors has dropped by almost 80 percent compared to last year’s record. This is still a far cry from the price that existed the day before sellers on Reddit, some of those who rallied on the r / WallStreetBets message board, contributed to the ‘slight squeezing’ to bring pain to betting hedge funds against the stock. But today’s entrepreneurs have moved a lot.

Sales volumes in GameStop and other so-called meme stocks such as cinematographers AMC Entertainment, Express retailers and Nokia affiliates have fallen.

Instead the investors rushed to other parts of the market, including the options they left out most last year. Due to the sharp rise in the market – the S&P 500 and Nasdaq are no longer hit hard after history – traders this month made history. buy equity put options. Contractors provide security and the ability to profitably slide in the market.

Strategists on Wall Street have found that many of the new options are bought and sold on the same day, indicating that traders are not just trying to hide themselves from selling. Instead, it appears to be trying to take advantage of intraday shifts at select prices.

Preston Seo, a YouTube promoter in the US, recently surveyed his followers and said most of them said they were looking for money, but were filling his box with messages asking for guidance.

“Most of these small investors seem to have confidence in ‘buying a dip’. But behind closed doors, they are starting to worry because they may not have encountered a problem like this,” Seo said.

The risk of rising interest rates has helped exacerbate that concern. The Fed this week suggested it do in March higher prices for the first time since 2018, chairman Jay Powell is leaving the door open for action to curb rising inflation and revive the fast-growing economy.

“People who put everything in it will find that there is no quick fix to getting rich. . . This kind of fantasy disappears, “said Randy Frederick, Charles Schwab, chief marketing and development manager at Charles Schwab.

Frederick added that the recent changes could provide a difficult lesson for new entrepreneurs who are investing in low-income investments.

“Every generation has to learn from their mistakes, no matter how long we have been trying to warn them,” he said. “It’s a slightly different game each time but the end result is the same. The challenge is to point out when it happens.”

Source link