‘Soviet Metal Exchange’: LME irks traders by freezing nickel market

The London Metal Exchange has enraged some of the world’s most influential electronic traders after it shut down its nickel market and unwound thousands of deals in response to a spike in the price of the metal.

Months after the 145-year-old exchange upset its traditional users by considering an end to raucous in-person dealing, the LME this week shut down its nickel trading – a market where it sets global benchmarks – in a move last seen in tin in 1985.

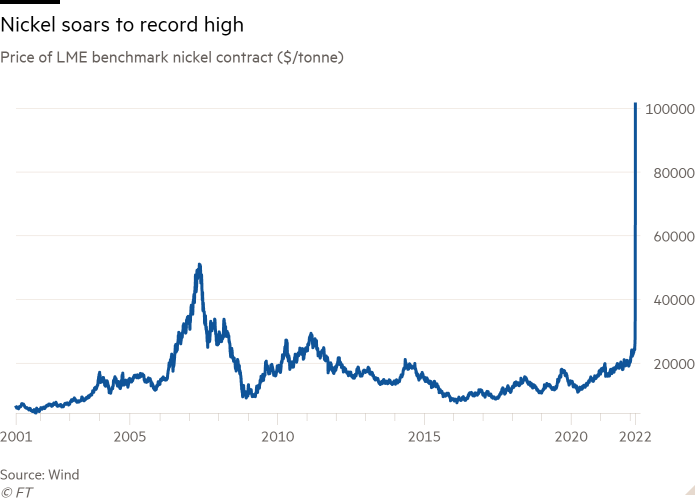

The crisis measure came after the metal’s value more than doubled in two days, to a record above $ 100,000 a tonne, as a large bet against the nickel price left the tycoon behind Tsingshan Holding Group, China’s leading stainless steel group, facing billions of dollars in potential losses.

But the exchange also canceled all 5,000 nickel trades that had been executed on Tuesday, worth nearly $ 4bn. Mark Thompson, vice-chair of Tungsten West and a longstanding trader on the LME, estimated the exchange had wiped out $ 1.3bn of profit and loss on the deals. It was “in the interests of the market as a whole”, the LME said.

Some market participants say that in effectively scrubbing the day from the record books, the exchange crossed a line. Not only did the LME fail to manage the risks, but it also picked up a side when it should be neutral, they say.

The near-150-year-old LME rankled its traditional users last year by considering an end to raucous in-person dealing. It eventually reversed course on the plans. © Bloomberg

AQR, one of the largest hedge funds in the world, is exploring legal options in its dispute with the LME after losing out on significant profits from the exchange’s decision, according to people familiar with the matter.

In a series of posts on Twitter, Clifford Asness, founder of the $ 140bn fund, described the LME as “slime balls”. This was, he said, the first time he had been told “you don’t get your legitimate profits because, gee, someone else, a broker who didn’t manage things so well, might suffer”.

“I’m accusing you [the LME] of reversing trades to save your favored cronies and robbing your non-crony customers, ”he went on. The LME denied that parent company Hong Kong Exchanges and Clearing had influenced its decision.

The exchange is in discussions with its regulator, the Financial Conduct Authority, and with the Prudential Regulation Authority, which monitors its clearing house. The regulators declined to comment on the matter.

The charge of favoritism may be hard to shift. The issue has hit a faultline all too familiar to the LME, between those members who trade on behalf of users wanting to buy the physical commodity for use in manufacturing, and electronic traders, who seek to profit from successful bets on the value and direction of the product.

Cancelling trades had been necessary because the size of the short position that had been racked up in rocketing nickel presented a systemic risk, said Matt Chamberlain, LME’s chief executive.

“One of our key responsibilities is to serve the physical traders,” he said. “If we allowed the trades to stand, we would have to say that the price of nickel is $ 80,000- $ 90,000 and that would not seem rational to the physical market. And we could have placed significant stress on a number of our core members. ”

Last year Chamberlain was frustrated in his plans to close the trading floor and turn the market fully electronic, after lively opposition from traders and industrial users. Now it is the electronic traders in uproar. Alex Gerko, co-chief executive of electronic market maker XTX Markets, labeled it the “Soviet Metal Exchange”.

“It’s potentially very damaging for its reputation. It’s electronic versus physical. What it reflects is the LME’s mentality is protecting the old boys’ club as opposed to the larger growing financial community, ”said one former senior executive involved with the LME.

Organizations behind the scenes of trading do have the right to close down trades, though this is rarely used.

Clearing houses manage the risks that can build up when traders’ bets get too large, and stand in between trades to prevent defaults from fanning out across the market. In this instance, the LME’s clearing house had the right to close down the tycoon’s trades if he could not pay the margin to support them, said Athanassios Diplas, of Diplas Advisors, a former credit risk manager at Deutsche Bank.

The exchange also has a “default waterfall” of financial resources that can be drawn on when crises hit, he said. “The first party that is supposed to be impacted is the defaulting party, before everyone else,” he said. “That’s not what’s happening here.”

Part of the problem is that Tsingshan’s position was so large and mainly held in derivatives that are not traded on exchanges, taken out with several banks, according to a person close to the situation. The exchange saw only a fifth of the full position, and became aware of the full scale only this week when the banks disclosed their holdings. It would be up to Tsingshan’s brokers, sitting on potentially massive trading losses, to close out those off-exchange positions.

“We are now focused on the mechanics of reopening the market as efficiently and as quickly as possible,” the LME said in a statement on Friday.

Untangling the knot to satisfy all its members may be beyond the exchange and it faces a battle to re-establish trust with its electronic users, Chamberlain acknowledges.

“We have a job to rebuild our reputation with that segment of the market. Where I think this offers the opportunity to us is to finally put in place the market protections we need, ”he said.

Those protections could include more disclosure of customers’ off-exchange positions – a move that Chamberlain has pushed as chief executive but has been resisted by banks. The LME has also imposed some emergency measures, including a 10 per cent cap on nickel moves.

The exchange has a dominant global share of commodities like aluminum, copper, nickel and zinc, ahead of CME Group, the Chicago futures exchange.

Nickel is expected to be a battleground of the future because it is used in electric vehicles. For now, the CME does not have a nickel futures contract but the LME’s stumbles may prompt a rethink, pushed by frustrated traders.

“These things don’t happen overnight, and it’s not easy to shift liquidity. But yes, we would definitely support that, ”said Yao Hua Ooi, co-head of macro strategies group at AQR.

“If they [the LME] lose the position they have in this metal, the LME’s growth opportunities are going to be quite dire, ”the former executive said. “If they don’t react, the CME will eat their lunch and the pricing benchmark will move away from London.”

Source link