Political uncertainty with Brexit will delay UK recovery in 2022, economists predict

The UK will follow other developed economies in 2022, economists interviewed in a Financial Times survey predict that this will be a setback and political uncertainty and the aftermath of Brexit.

Of the nearly 100 economists, many have said that life in the UK will be even worse in the coming year, with poorer households deeply affected by rising prices and taxes.

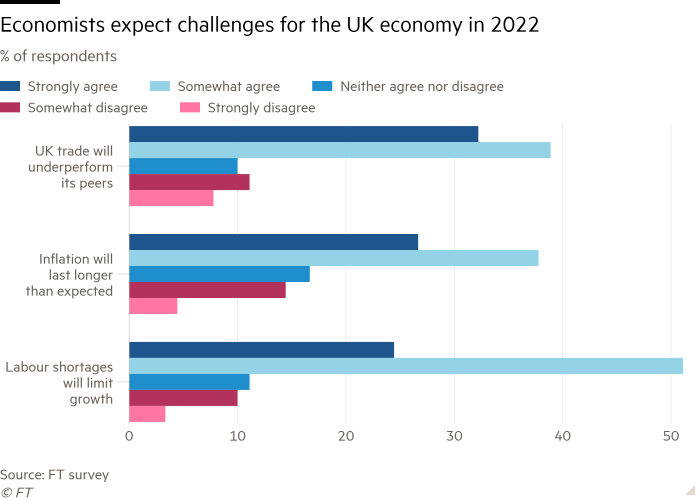

The biggest problems they saw facing the country’s economy were global: rising electricity prices and rising epidemics; the constant shortage of workers and the disruption of supply chains; further waves of viral infections; and the increasing risk of climate change.

But many argued that the UK would find it more difficult to deal with the crisis than its counterparts, because economic aid was on the rise, Brexit was destroying trade and exacerbating the financial crisis, and political uncertainty seemed to be holding back money.

“The combination of the Brexit crisis and the political uncertainty continue to undermine what would otherwise be the best solution,” said Jagjit Chadha, director of the National Institute of Economic and Social Research.

“Recovery is driven by hope for the future. . . “Brexit will create uncertainty in the UK’s economic future,” said Paul de Grauwe, a professor at the London School of Economics.

In the face of this, these doubts may seem overwhelming: a number of respondents suggested that the volume of domestic goods in the UK should increase or compare with the eurozone by 2022, although the stimulus would encourage rapid growth in the US.

Kallum Pickering, an economist at Berenberg, said consumers have the advantage of having a “good reputation, a growing labor market and a huge pile of big money”, while businesses had strong intentions to buy.

But Paul Dales, a UK economist at Capital Economics, described strong growth as a “epidemic”. He and a few others noticed that the UK economy was growing rapidly as it sank into a deep pit, with GDP levels back to its 2019 level.

By addressing all the norms that came into effect in the UK in 2022, many said that Brexit would exacerbate the epidemic, and the closure of labor and unemployment would continue even more than in other countries, and inflation would intensify.

John Llewellyn, an independent consultant, and Sushil Wadhwani, an asset manager and former Bank of England rate setter, said this would force the BoE to tighten monetary policy more than other central banks, reducing UK revenues compared to its counterparts over time.

Although some have given a report to the government as a result of the fight against the epidemic last year – in particular, the vaccine run – there was little confidence that ministers would continue to support recovery.

Wadhwani also spoke of the government’s “suspicion” in helping businesses affected by the Omicron coronavirus, while Barret Kupelian, an economist at PwC, cited “tax cuts” and Morten Ravn, a professor at University College London, said it was a huge debt to the UK. It meant that “it would be difficult to make incentives or significant tax changes”.

For some, the government itself was a major factor. A number of irregularities have disrupted the election of Boris Johnson, Prime Minister, and increased interest in leadership. Respondents cited “unstable politics” and the lack of a reliable plan to promote long-term care.

Panicos Demetriades, a professor at the University of Leicester and former vice president of the central bank Cyprus, predicted that there would be questions about the care of the Brexit government and Johnson “without discrimination, or chaos”. Pickering said the potential crisis in Johnson’s leadership could “encourage companies to remain ‘waiting and seeing’, and suspend financial decisions until the financial situation is clear.”

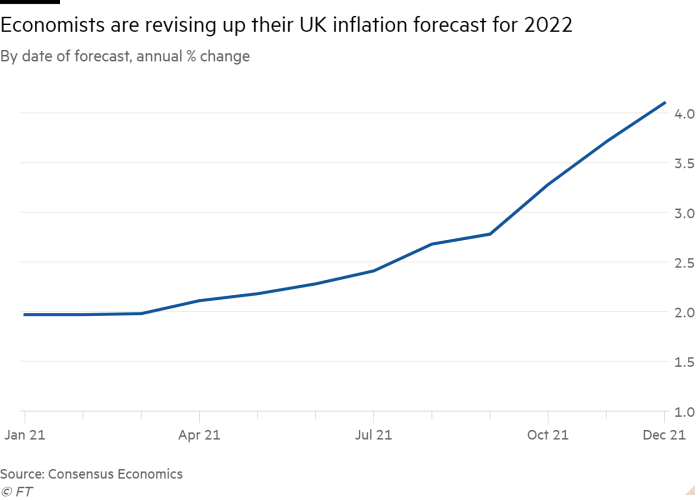

One problem that has not been created by the government, however, will determine how things will turn out in the family in the coming year: rising prices. It hit 5.1 percent in November, its highest level in more than a decade, and should rise in the first quarter of the year and remain above 2 percent of the BoE by the end of 2022.

Almost all respondents said this would leave people at a disadvantage at the end of the year, as many wages would not be in line with rising prices and taxes.

“Regardless of the epidemic in 2022, most of us can expect to have a financial crisis,” said John Philpott, an independent consultant. Low-income workers, or those benefiting from significant increases in minimum wage, are doing well, he added, but many will not be able to afford the actual wage if unemployment is stable.

“We want to squeeze new payments in the coming year, which will affect low-income families,” said Alpesh Paleja, an economist at the CBI.

Some respondents said families should keep spending even when squeezed, because they can use the money they earn during the closing period, while DeAnne Julius, a Chatham House colleague, said that if wages were among the lowest paid, then unemployment was more pronounced. , then “more people will feel better than they do now”.

But Melanie Baker, an economist at Royal London Asset Management, warned that the year was a good start for workers in the Omicron-affected areas, with no plan to finance the lost money.

David Bell, a professor at Stirling University, said the living crisis would be “difficult” for poor families, who spend a lot of money on electricity. And Dave Innes, chief financial officer at the Joseph Rowntree Foundation, said the support of millions of people who are unable to work due to illness or disability would be very low since 1990.

Yet while these disagreements were the same in terms of the domestic economy, there were differing views on what the BoE could or should do to avoid financial crisis.

One group feels that monetary policymakers can do little about inflation that has been largely due to the epidemic in the wake of the crisis – a crisis that could be reduced by the end of 2022, whatever the central bank did.

“The current rise in inflation is not a matter of money. . . To me, the biggest threat to inflation seems to be a shift in prices, “said Christopher Pissarides, a professor at LSE, adding that the BoE inflation in December could affect secrecy interests and Chancellor Rishi.

“The way central banks ‘control’ inflation is exaggerated,” said Ann Pettifor, chief executive of Policy Research in Macroeconomics.

But another group said the BoE should be prepared to raise interest rates, as they have started, to prevent falling inflation into a stable state, as traders and workers expect inflation to increase, and set their prices and wages fairly.

The group found the BoE to be “impossible”, and “would be against inflation”, with the risk that inflation could stabilize if the epidemic changed the labor market, or if Covid-19 became commonplace, with any new diseases. directs the exchange of prices between goods and services.

Kate Barker, a former member of the Finance Committee, said “being prepared to act here should reduce the need for inflation to keep us afloat”. Melissa Davies, an economist at Redburn, said the BoE’s problem would be “a clear understanding of the middle of staying reliable here and not disrupting recovery in 2022-2023”.

Although there was no hope of growth, rising prices and livelihoods, a few respondents struggled to predict that it would not be “a complete and utter ruin” in the coming year.

They saw the long-awaited long-term business recovery, due to unemployment, Covid-induced digitalisation and the need to adopt green technology. This could “enable businesses to create the necessary types of income to reduce their dependence on low-income jobs,” according to Nina Skero, Cebr executive director, although she and others stressed that real progress in manufacturing could take years, and needs. a major push from the government.

The following year, however, the economic situation in the UK should be less dependent on the effects of inflation or inflation than the epidemic has taken. As Andrew Hilton, executive director of the Center for the Study of Financial Innovation, predicted, lower tariffs would burden consumers more than “the darkness that comes with the fear of permanent closure”.

“Let’s anticipate an increase in post-epidemic epidemics – in the end. That’s what we expect by the year 2022 to hopefully end,” said Diane Coyle, a professor of public policy at Cambridge University.

Kitty Ussher, an economist at the Institute of Directors, also predicts the future. “Ours is an economy that wants to grow,” he said. “As long as people believe that the worst pandemic is about to end, the great need for sustainable development.”

Source link