Large quantities of electricity come as the plague progresses

Ten years ago the stock market was in the throes of a major upheaval as retailer Glencore set out with a blockbuster $ 60bn list on the London Stock Exchange.

A decade later, the sharp rise in commodity prices and the resumption of China-sponsored “corporate beef market” sales, the government’s spending on post-epidemic recovery and betting on “planting” the global economy.

“If we hope to see a solution soon to [pandemic] in India, then in our lifetime we have never seen such a large economy set up, “said Saad Rahim, chief economist at Trafigura, one of the world’s largest retailers.

“We have come from China to be the only trade issue in the last 10 years and now the whole world is taking the baton and being instrumental in influencing the equation.”

Last week it saw iron ore, an essential element in the production of iron ore, palladium, used by manufacturers to reduce emissions, and all timber has risen sharply. Major agricultural inputs including cereals, oilseeds, sugar and milk have also jumped, corn prices rose $ 7 bushel for the first time in eight years.

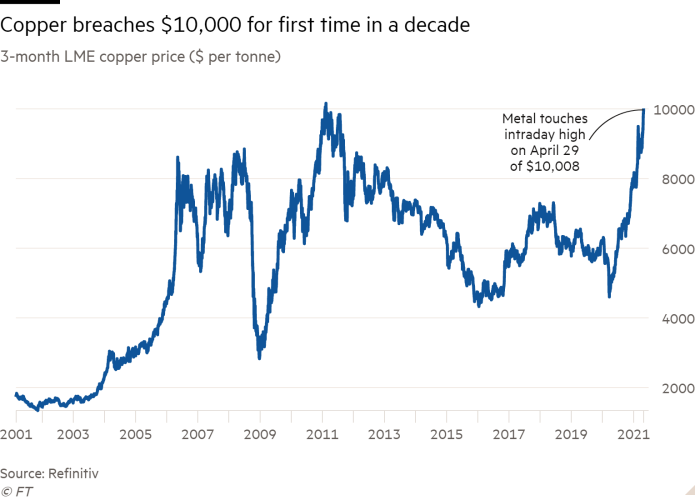

Immediately copper, the world’s most valuable metal, sold for $ 10,000 for the first time since 2011, when soyabeans turned eight years old. The S&P GSCI index, which tracks price trends on 24 products, is now up 21% this year.

After being unpopular for the past decade, expert predictions in some areas about another supercycle – long-term pricing higher than expected – have attracted sellers.

The commission has also provided funding from fundraisers looking for a profitable economy as the global economy grows rapidly in the epidemic, and this could also serve as a barrier to rising prices.

“President Biden has now made two more plans on top of the previous one. If any of this happens you are just selling this. This is just the beginning,” Rahim said.

Recovery in China, where the world’s largest consumer goods market, as well as in Europe and the US, where the housing market is growing, has boosted demand. The small and confusing discomfort associated with Covid also added fuel to the fire.

“I don’t know if we’ve ever seen anything like this,” said Ulf Larsson, head of Sweden Interior and timber company SCA, which announced a 66% increase in profits for the first quarter on Friday. “We’re in a storm in some way.”

An essential weapon for electric batteries for cars and electric vehicles, from lithium to rare countries, has also been swept away in excitement.

China’s famine has caused prices of lithium carbonate and lithium hydroxide to rise more than 100% this year, according to Benchmark Mineral Intelligence, after nearly three years of decline. Earth’s oxide neodymium-praseodymium (NdPr) oxide, which is used in electric motors, rises by about 40%, such as cobalt, a battery of iron.

“You have an EV supercycle and you add a real commercial supercycle on top of that – it’s a mining game,” said Simon Moores, executive director at Benchmark Mineral Intelligence.

Cargo loads on fuel trucks are also assembling. The price of palladium, a metal used to convert filters, rose to $ 3,000 on Friday, while Europe and China are doing well.

This should continue to decline in global car sales, according to experts at Jefferies.

Oil prices have also risen sharply, recovering from epidemics ahead of more than $ 65 a barrel since the beginning of the year. While demand continues to stagnate due to the slowdown in global travel it has resumed once the economy has reopened. Opec and its allies as Russia continues to ban offers – they are slowly adding barrels to the market to boost prices.

Goldman Sachs said this week that it expects to see oil prices hit $ 80 a barrel in the second half of this year, warning that there could be a sharp decline in summer as vaccines run and people go on holiday, boosting the demand for more than 5 percent worldwide. .

While the Opec + team may be able to recover yields if prices rise sharply, some researchers are concerned about the long-term prospects as electricity moves away from oil.

Christyan Malek, a JPMorgan analyst, says there could be a major crisis in the next few years, with the $ 600bn shortfall predicted by the mid-term inflation rate by 2030.

How long the acquisition will take, however, is worth arguing for. “This is a small supercycle,” said Alex Sanfeliu, chief of Cargill’s global sales team, referring to the abundance of agricultural inputs. “I don’t think it will be as long as the last one. Marketing and demanding are in full swing now. ”

Shekar at Olam International, an agricultural retailer in Singapore, said he did not see a rise in food prices. However, he predicted that demand would remain strong for the next six to twelve months as consumers eat after a hard year. “This could drive prices up,” he said.

Some are skeptical of the idea that we are entering a supercycle at all. “We think the conference will continue for a while, but this is happening more than just big business,” said Jumana Saleheen, CRU’s chief financial officer.

Source link