Wall Street stores are expected at the end of the Fed meeting

Shares on Wall Street held a meeting on Monday, clearing out the damage at a two-day US meeting at a bank that will monitor their financial performance.

The Wall Street S&P 500 index finished 0.2% in New York, having lost 0.2% less than an hour before the final bell rang. It will also show another up on the list following a 0.2% follow-up on Friday. The technology described the Nasdaq Composite index which rose 0.7 percent.

The largest U.S. government debt has been sold, taking its yields over a 10-year U.S. Treasure rate of 0.04 percent to 1.49 percent. This was followed by a gathering last week when traders deposited money in the Federal Reserve despite not seeing high prices in the US to continue to support the financial markets.

The fund is expected to retain its $ 120bn monthly purchase when it meets Tuesday and Wednesday. The acquisition, which has been followed by price makers in Europe and the UK, has lowered yields at state governments, reduced corporate lending and boosted interest in risky assets such as finance.

But he recovered quickly US steel with the help of the coronavirus vaccine and President Joe Biden’s advocacy programs, some experts see the Fed’s policy makers bringing predictions of a new rise in the epidemic risk.

“We hope the Fed will change its stance on growth and revitalize what has been said,” Tiffany Wilding, a US economist at the Pimco bank, said in a statement. “We think most of the Fed’s officials have resumed their protests at the first rate hike in 2023 [from 2024]. ”

The headline price tag in the US has arrived 5 percent in the 12 months to May. Jay Powell, chairman of the Fed, also said the rise was a temporary one after the US economy reopened after a coronavirus outbreak. “But some are worried that prices are going up,” said Marco Pirondini, chief of US agencies in Amundi. “I would say it’s 50-50 on each side.”

Rising car and vehicle prices, the decline in global semiconductors has reduced car production, it has been about one-third of the CPI increase in May, according to the Bureau of Labor Statistics.

U.S. wages could also be “excessive”, said Pirondini, after Biden signed a law in late April to increase government spending, forcing business companies to also raise money.

Across the Atlantic, the area around the Stoxx Europe 600 gained 0.2% at some point, with energy exerting a strong influence on rising oil prices.

Brent crude rose 1.3% on Monday to $ 73.64 a barrel, two years on the world oil level, before taking a break from finishing 0.4%.

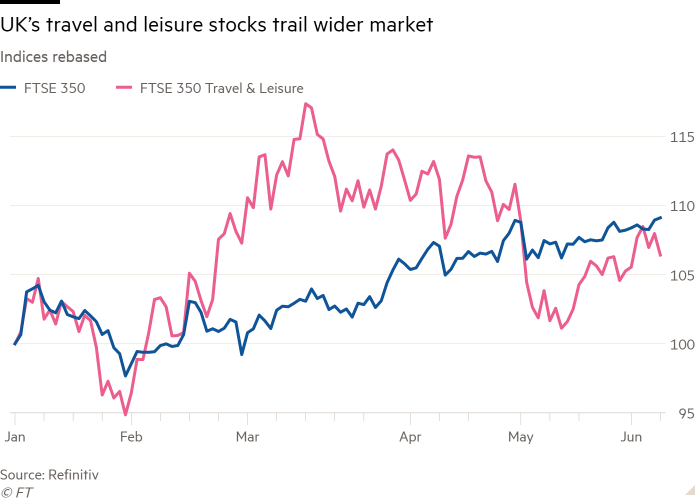

Elsewhere in the region, travel companies and resorts in the UK were about to sell, reopening all assets. is four weeks late.

The control and rest ratio of the FTSE 350 was 1.4 percent lower compared to the 0.2% rise in the main FTSE 350 display.

The dollar, which measures the US dollar against its counterparts, sank 0.1 percent. The euro rose 0.1% against the greenback, buying $ 1.212. Sterling carefully finished the $ 1.411.

Unsafe – Market, economic and strong ideas

Robert Armstrong disrupts the most important events in the market and discusses how well Wall Street positive ideas respond to them. Enter Pano for this letter to be sent to email every week

Source link