Household growth: US house prices rose 18.4 percent in October | Home Affairs

The hottest markets were Phoenix, Arizona (up to 32.3%), Tampa, Florida (28.1%) and Miami, Florida (25.7%).

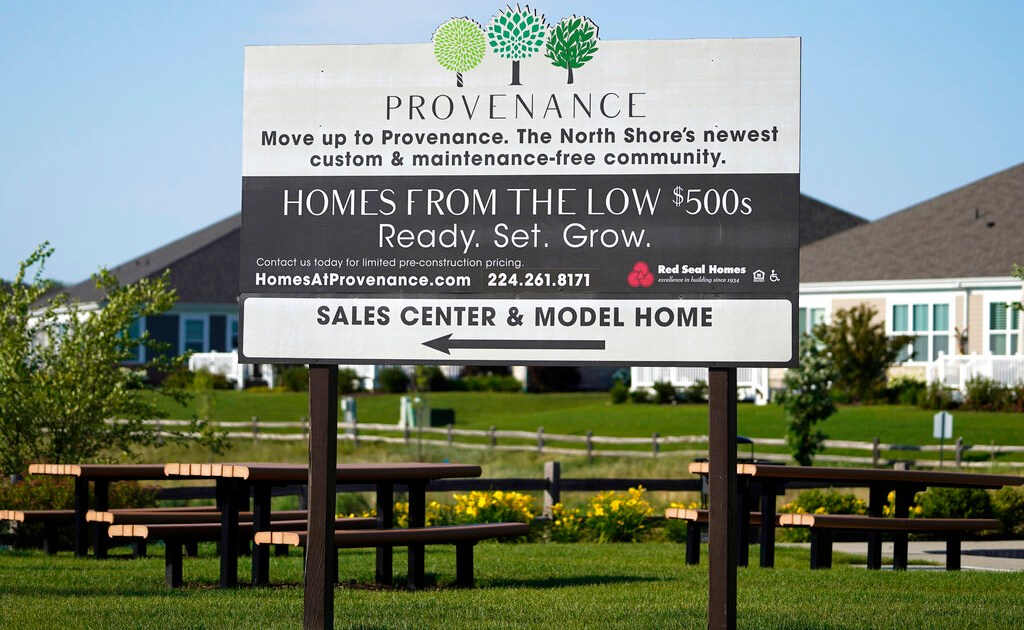

US house prices soared in October as the home market grew sharply due to last year’s economic downturn.

S&P CoreLogic Case-Shiller 20-city home index index, released Tuesday, rose 18.4 percent in October since last year. The gain showed a slight decrease from the 19.1% annual increase in September but was in line with expectations of economists.

All 20 cities received digital benefits twice a year. The hottest markets were Phoenix (up 32.3 percent), Tampa (28.1 percent) and Miami (25.7 percent). Minneapolis and Chicago put up a lot less, 11.5 percent each.

The housing market has been strong, due to low mortgage rates, declining housing prices, and the need for buyers who were closed last year by the epidemic. Many Americans, tired of living at home during a pandemic, are looking to sell from home to apartment or mansion.

“Growth in housing prices is slowing down next year, but keep rising,” said Danielle Hale, an economist at Realtor.com. “As homeowners spend a lot of money on homeowners, buyers gain skills. Many have taken advantage of the labor market to relocate to rural areas where even though they have found housing prices, many can still find a lower price per square foot than in nearby cities.

It is unknown at this time what he will do after leaving the post.

“We have already said that the strength in the US market is driven by the changing environment in which families are experiencing the COVID epidemic,” Lazzara said. “More information will also be needed to understand whether the quantity of these items represents an increase in the number of events that would occur in the next few years, or is indicative of global change.”

Last week, lending rates fell to 3.05 percent over 30 years, fixed and 2.66 percent for 15-year-old fixed-income loans. Continuous inflation shows that mortgage markets appear to be more concerned with Omicron’s economic downturns that are downward than inflation. about 40 years.

The National Association of Realtors reported last week that the sale of residential properties rose in the third straight month of November to an annual adjustment rate of 6.46 million.