Omicron adds to the skepticism of the ECB’s commitment to reform

Proponents of her case have been working to make the actual transcript of this statement available online.

Three recent developments have sown doubts in the minds of some investors in the ECB, which have been predicting for months that inflation will return to normal and ensure the continuation of major incentives.

The first was the rise in eurozone inflation to 4.9 percent in November, above the ECB rate of 2 percent and history since the euro was formed two decades ago. This was followed by the release of a a new type of coronavirus, who he threatens prolonging the plague and preventing inflation.

Then last weekend, the US Federal Reserve he said will hasten the end of its bond-buying program to curb rising inflation, putting pressure on the ECB to review its purchasing plans.

Ahead of next week’s ECB meeting, analysts are concerned that together they are increasing the chances of a “hawkish” change by price fixers to remove earlier stimuli than expected by investors, and boosting market capitalization in the eurozone. .

“At Omicron, it is clear that it will continue to rise in inflation for a long time due to the long-term disruption of the supply chain,” said the ECB executive committee member.

“The epidemic has changed the economy, overworked households, high carbon prices and the breakdown of globalization,” the council member continued. “In the medium term, inflation can be much higher than we want and we need to take action.”

The central bank is expected to announce at its next Thursday meeting that it will stop new purchases in March under the € 1.85tn emergency program set up to deal with the epidemic. But ECB policymakers could also delay further speculation about the amount of bonds they can buy in 2022 until early next year.

“I will not be happy to do anything at the end of the second half of next year,” said a second member of the council. “Markets should have this.”

A third member of the council said delaying his decision on future purchases was possible “in line with the epidemic and new ones in the next two weeks”.

The ECB has bought more than € 2.1tn in bonds over the past two years, which is higher than the total eurozone bonds it has offered to reduce lending.

But experts at UniCredit calculated that this could change next year, although eurozone governments are expected to raise less debt, unless the central bank increases the number of bonds it buys under the antiquities program up to € 40bn a month from April to the end. on 2022.

By continuing to buy big goods next year, the ECB will be even more effective compared to other central banks that want to stop buying stocks soon, including the Fed and the Bank of England. Bank of Canada has already done this.

Consensus is growing on the ECB council that there is no added benefit in increasing monthly inflation rates based on rising inflation, according to two of its members. “There is no need to expand the post-March procurement program,” said one.

Researchers speculate that the ECB may commit to an additional “envelope” for bond buying after March next year. But they said their idea was flawed because it was close to raising inflation for 2022 to 2 percent next week, making it difficult to articulate a commitment to continue buying more bonds.

“Surprises have been exacerbated by rising prices and the revision of the ECB’s forecast for 2022 will be one of the highest in the history of these forecasts,” says Frederik Ducrozet, an expert at Pictet Wealth Management. He expects the central bank to raise its inflation rate next year from 1.7 percent to 2.7 percent.

Reinhard Cluse, an economist at UBS, said: “The forthcoming summit could be one of the biggest challenges for the governing body in the near future, given the low cost of living. ECB connection “, he added.

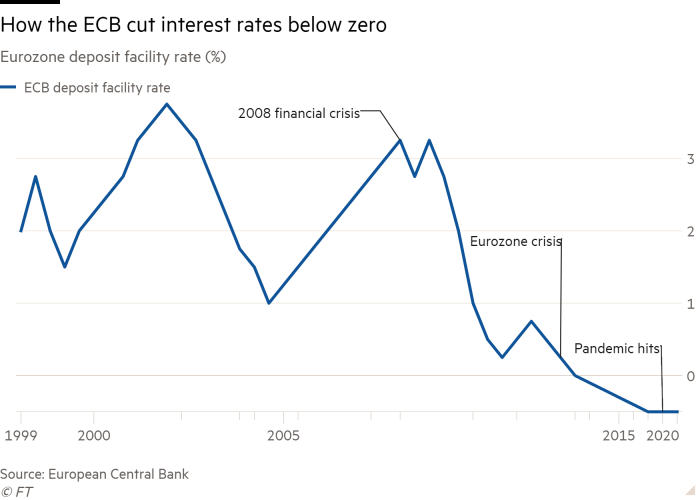

Christine Lagarde, President of the ECB, he said last week that the bank was “highly suspicious” to raise its interest rate from 0.5 percent next year, as it still expects inflation to fall below its target by 2023.

Despite Lagarde’s comments, markets are still pricing at 0.1% higher than the ECB by the end of next year, even though last month traders were trading at a double rate in 2022.

“They’ve used the message so much that it’s over,” said Antoine Bouvet, an academic at ING. “One of the biggest challenges has been the Fed, whose influence goes into the eurozone.”

The ECB has vowed not to raise prices until it stops buying, which economists say will not happen before 2023, even if it continues to repay bonds over time. “They can finish buying in 2023 and it is possible to see the first rise by the end of 2023,” said Katharina Utermöhl, an economist at Allianz.

Source link