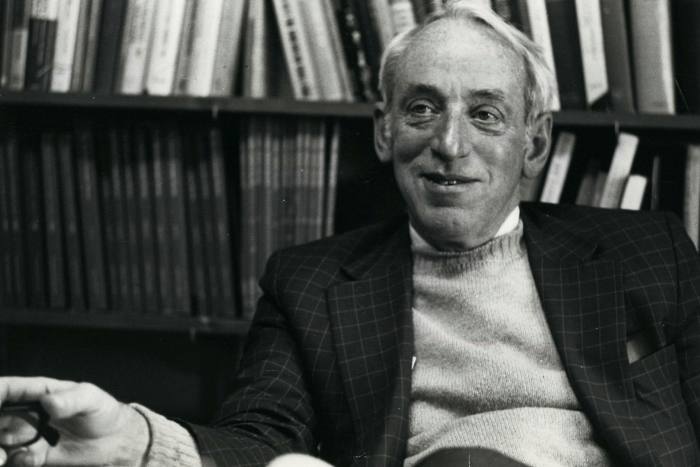

David Swensen, a pioneer from Yale who had a change of heart

On Monday, David Swensen taught former students to invest in Yale University, even though they had cancer. Two days later, one of the cash greats finally paid he loses, Died at age 67.

The money-making industry has produced more than just bribes and brutal tycoons, tragic failures and frauds. In Swensen – which managed to raise $ 31bn since 1985 – it had a lot of setbacks, which seemed to be unfair to the economy when it transformed the companies that run it.

“The best artists are the ones who change the way other people paint, like Picasso. David Swensen has changed the way everyone who is interested in making money thinks about making money,” he says. Charles Ellis, Who led the Yale gift between 1997 and 2008.

“The results were good, but they were designed so that they would not be surprised,” adds Ellis. “When you see a great chef preparing for the kitchen, you know the food will be fine.”

Swensen he never commanded the popularity of Warren Buffett, Peter Lynch or Jack Bogle, but among those who live within the industry he sees them as numerous. Ted Seides, former colleague and author a book for distributors, describes his former boss as an undisputed GOAT – the biggest ever.

“They always come up with new ideas, new homes, new ways,” he says. But even though his wealth makes him more powerful, Seides argues. “The same type of (Yale) is so unique that almost everyone who has worked in the Yale endowment has done well. It’s like Goldman Sachs or Tiger Management in the world of education.”

Like many good works, Mr. Swensen had an unexpected start. When he first came to Yale University in 1985, he initially thought it was a teaching job – not a $ 1.3bn investment. Other than that, he was only 31 years old at the time, full of financial ideas but sadly he didn’t know the money.

Donations are liquid water from wealthy donors – especially university students – who go to pay for staff fees, pay for tuition or repair school buildings and running programs.

Install the trigger

After graduating from Yale with a PhD in economics in 1980, Swensen wrote his thoughts on seeing corporate integration as a viable economic activity. At Salomon Brothers – the centerpiece of the brash, freewheeling 1980 Wall Street – helped create the first interest rate exchange, between the World Bank and IBM. But he had no knowledge of the companies themselves.

However, when Yale called he received an 80% seizure and did the job. The subsequent work contributes to the reorganization of more and more currency exchanges through the exchange of capital, hedge funds and financial industries. Being a reader was a blessing in disguise, a distraction from the Swensen on the ordinary.

At the center of the so-called “Yale Model” are the lessons Swensen learned from his mentor, Nobel laureate James Tobin.

© Alamy

Tobin had played a special role in the need to invest a variety of investments – building on the “modern ideas” of Nobel laureate Harry Markowitz – a fact that Swensen married for a long time.

The brand encourages the spread of more and more risks – but in the long run, more recurring stocks will spread to public and business markets to reduce risks. For Swensen and Yale, this meant investing in what was once a nascent hedge fund, private equity and investment firms, as well as real estate agents and eventually hiding like timber.

The stability now established, this method of distributing wealth was exciting at the time. The Yale Model came at a time when many universities were changing stock-and-bond records – often with a 60:40 split – and no gift was considered worthwhile around the world.

Swensen initiated a change, with the money eventually being diverted to “other” savings businesses such as heirs and wealthy heirs, changing hedge funds, operating funds and financial institutions.

The results were amazing. The program of Yale Investments Office has achieved $ 31.2bn since June 2020 – accounting for a 12.4% annual return over the past 30 years – and provides one-third of the university’s budget.

Although Swensen was not the only developer, he is known to have done well. He also liked it, when the acolyte army described how they used the money and donations in the US.

Swensen had a “magical power of business acumen”, says Paula Volent, who has spent $ 1.8bn at Bowdoin College in Maine for the past two decades and has worked for Yale’s office for some time. “It helped change many of our lives.”

Vanderbilt Hall is located at Yale University © Craig Warga / Bloomberg

Hands of poker

His interest in teaching was not limited to theaters. After a series of long meetings, they play late into the night with their co-workers in the financial offices, not for a lot of money, but for the same games. Between hands, he was able to search for the treasure that came that day.

“He understands the importance of quick choices and is not afraid to play hard when he thinks the challenges are in his favor,” he says. Robert Wallace, whom Swensen hired as a student at Yale in his mid-30’s, is studying economics after working in ballet.

Wallace worked under Swensen’s administration for five years, before establishing a family office and moving money to $ 29bn at Stanford University. But she still remembers those happy days. “I think I learned a lot from David when we chatted at the table like I do at meetings,” he says.

For those who are not at the poker table, Swensen’s 2000 magnum opus, Historical Pioneer Service, allowed them to grasp his financial wisdom.

The wrong fit for Wall Street

Pa Related Capital, a $ 40bn fund that oversees funding instead of donations and charities, the book is eligible for inclusion in the new works, and its founder Stan Miranda paid tribute to Swensen’s achievements.

The book “was a money-making skill”, he wrote in a memo to co-workers. “(It’s) a powerful long-term management plan.”

Swensen was born in River Falls, Wisconsin, in 1954. His father was a professor of medicine at the University of Wisconsin, and his mother was a Lutheran minister. helped to stabilize more than 100 foreign refugees there. His background may explain why he did not invest in a bank.

“I love competition on Wall Street, but – and I’m not making a profit here – it wasn’t the right place for me because the result is that people are trying to make more money,” Swensen said earlier. Yale alumni magazine. “That doesn’t bother me.”

He was still accepted: the $ 4.7m salary he paid in 2017 made him the highest paid in Yale. But there is no doubt that her family would have made a lot of money. Had he had a small shield the size of Yale’s gift – and his return – Swensen would probably have been billions.

His friends and colleagues are showing their commitment to Yale’s athleticism, his fierce competition when it comes to the “Stock Jocks” softball team and his kind gestures. As Tobin’s legs began to paralyze him, Swensen began shooting snowballs at his teacher’s door every day in New Haven’s winter, Ellis recalls.

The question now is who will follow Swensen – or if someone else can. Miranda thought that the Yale Model would be “like a cartoon, it is just as important after the artist has passed”.

The most natural successor is Dean Takahashi, A former Swensen veteran, who is now running a climate change project in Yale. But Ellis feels that the challenges facing every investor are far greater than the Swensen debts in 1985, given the number of shares, the amount of interest, and the fact that Yale Model, a former pioneer, copied around the world – with varying success.

“I wouldn’t want to be second in David’s line,” says Ellis. It is an idea that many of her friends and acquaintances agree with. “David could have a successor, but not a replacement,” Wallace says. He was special. ”

Swensen is survived by his wife, Meghan McMahon, three children and two stepchildren.

Source link