Chief Reckitt signs new season and sells China baby formula

When Reckitt Benckiser acquired a baby milkmaker Mead Johnson for £ 13bn four years ago, the head of the retailer called it a “women’s response”.

But for Reckitt, the deal did not give Rakesh Kapoor the benefit he had hoped for.

China’s most important trade in Mead Johnson continued to decline due to declining births and rising local competition. By the time the company had it has been sold most of its Chinese baby milk shares last month, recorded 8bn in value.

Now Laxman Narasimhan, Kapoor’s successor, wants to escalate Reckitt’s sanitary scourge to reopen a company that some retailers and experts say was injured in an attempt to merge Mead Johnson.

Narasimhan, who replaced 2019, “received a business that needed a major overhaul, a business that did not have a lot of money. [in]”,” Said Iain Simpson, a researcher at Barclays.

With the sale of all but 8% of Chinese children’s groups, Narasimhan wrote a line that was “a huge galaxy error,” Simpson said.

Changes in line with market fluctuations

Narasimhan’s challenge now is to reintroduce the Reckitt competition in the ever-changing consumer market thanks to Covid-19. Sales of contact-related products, such as Durex Reckitt condoms, resume when the vaccination programs begin. Durex also reported double-digit growth in the first quarter compared to the previous year.

But the importance of allergies and colds such as Reckitt’s Lemsip, Mucinex and Strepsils has declined. The company estimated that coughs, colds and flu were reduced by 90% in the last winter due to anti-Covid measures such as social isolation.

Narasimhan removes the commercial decline as a plague. “When things open up, like emergency jobs move in and people get to hang out, we see an increase in the flu,” he said. “Now, some of this will play after this year and next year. But the flu will come back. ”

Outside of China, sales of former Mead Johnson baby products such as Enfamil, Enfapro and Lactum have been strong, including in the US and the Philippines, despite evidence of birth control complications.

A major question for Reckitt is the stability of the antimicrobial boom that has greatly boosted the sales of its Dettol and Lysol products. Dettol sales were broad in the first quarter, compared to the previous year, although Lysol grew significantly, contributing to a boost in Reckitt’s 28.5% hygiene sales.

This reflects the areas in which the business has been sold, the company said, while Dettol is being sold in countries that have done well to combat the epidemic. But viewers share the length of the spread of pathogens It will end, mainly because the Covid-19 travels by air and spreads frequently in the area.

The epidemic has boosted the sales of Reckitt’s Dettol, and helped raise money for a quarter of its sanitation team © Facundo Arrizabalaga / EPA / Shutterstock

Simpson said one of the effects of the epidemic was “to raise awareness of the risk of infection. It will be long-term and long-term.”

But Steve Clayton, manager of UK Select Funds available at Hargreaves Lansdown – which had a stake in Reckitt until two years ago through Growth Shares and Income Shares – has no doubt. “Obviously, the world will be tired of sitting at a table soon?” he said.

“Reckitt faces the challenge of having the right stock in the right market. The mistake that can easily get your claim denied is to fail. ”

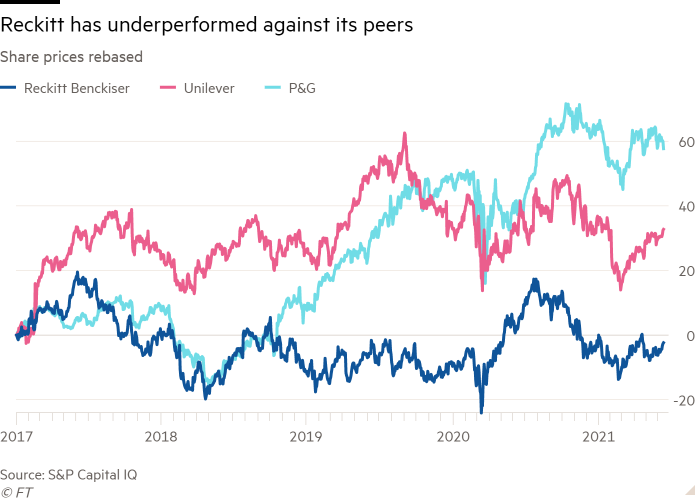

The group’s stock dropped more than one-fifth of its value by February, having hit the $ 77.54 epidemic in July, with Terry Smith, a well-known UK manager and former Reckitt retailer, selling its price by the end of 2020.

But investors have also found hope, sending the share price 11.3%.

Old mistakes

Bart Becht, Kapoor’s predecessor, is known to be the creator of the Reckitt shopping team, which includes products such as Nurofen and Gaviscon. But divisions have made mistakes.

“We think Reckitt’s reputation in the hygiene market is sometimes left untouched in an attempt to understand how to use commercial products. The culture of innovation and strong marketing… Is not always good with initial security,” Clayton said.

Under Kapoor, whose salary was one of the highest in the FTSE 100, Reckitt was criticized by Australian authorities for selling Nurofen as an anti-inflammatory and not an anti-tumor drug. The company also suffered from a failure to install Scholl’s electronic file in 2016. It also apologized for that year due to the number of people who died as a result of contaminating insects sold in South Korea.

Scholl was sold this year to an independent firm in the US, while Reckitt is selling more on research and development.

Narasimhan is doing “all the best… This is a business that is more lucrative than it was, the market performance is looking good, and the business is well connected with the participants,” Simpson said.

Mead Johnson’s acquisition came after Kapoor’s failure to find a way to work for Pfizer, which is now part of a deal with GlaxoSmithKline.

One of Mead Johnson’s buyers’ ideas was to promote Reckitt’s presence in China. It gave them a hard time in China, one of the fastest growing markets in the world. . . He tended to be there, “Simpson said.

However, the sale of Chinese-owned enterprises remained in a state of disarray as birth rates dropped and the government was forced to encourage domestic milk producers. The new owner of the room, Primavera, is Chinese.

The Chinese government has also encouraged new baby milk producers © Andy Wong / AP

However, China’s Reckitt business, even without infant formula, now looks very different. It cost about $ 700m last year, compared to $ 861m in child support.

Sales of vitamins, minerals and supplements such as the Move Free brand have increased dramatically. “Given [of illnesses] it is now rooted in our values, ”said Narasimhan.

Late last year, Reckitt selected China to launch the Durex polyurethane brand, which is non-abrasive as it is soft and smooth, according to the company. “We expect China to continue to be an important market for new products,” Narasimhan said.

Border problem

Samuel Johar, Buchanan Harvey’s London advisers’ team, said Narasimhan was spending the first few years of his leadership problems from Kapoor, where Kapoor spent his early years and experienced the benefits of Becht’s transformation.

“In such a large company, the experience of the first three or four years of senior management is much lower than what they are receiving – correctly and incorrectly,” he said.

Clayton said Narasimhan was beginning to “get better”, but added that he would face “permanent challenges. Reckitt finds limits on the edge of the oil and shifts the steering while sitting on the hard edge is always a trap.”

But the battles hitting Reckitt shares – the best legacy from Kapoor – have also helped protect against price swelling is interested in the session, says Simpson.

“They have less access to the area than most other real estate companies and other caregivers because their pages are so high,” he added.

Source link