Bitcoin rises to a higher level after a rise in inflation in the US | Crypto News

The largest digital assets at market prices rose to 3.3 percent to $ 44,085 on Wednesday.

Author Bloomberg

Published on 12 Jan 2022

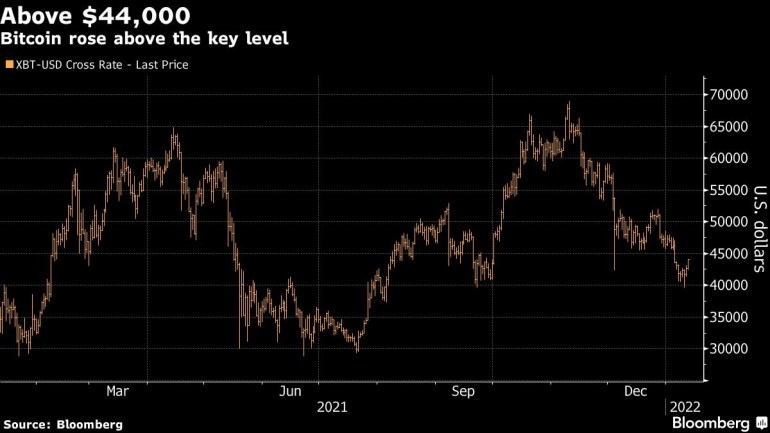

Bitcoin rose above $ 44,000 for the first time in a week when a 40-year US price hike stirs up controversy over whether cryptocurrency is a barrier to rising consumer prices.

The largest digital assets and market price rose 3.3% to $ 44,085 Wednesday, following a release of consumer numbers, which rose 7% in 2021. This means that inflation in the US recorded its largest annual profits since 1982. Some market traders he thought the increase would be higher, helping to send other so-called dangerous items such as high-level goods.

“Inflation today was in line and the Fed may not want to contribute to its tightening, meaning that the perception of cryptocurrencies is probably on the right side,” said Michael Reynolds, vice president of monetary policy at Glenmede. “As is the case, slowly, in attracting cash when the Fed raises prices, we can expect it to take a toll on crypto-currency trading.”

Crypto proponents have been arguing that Bitcoin and other digital assets, due to being an idiosyncratic economic group, could act as a barrier to other areas of the financial market. Only 21 million Bitcoin will be used under the computer system that oversees the release, although that number is not expected to be reached for decades.

Other cryptocurrencies also resurfaced Wednesday following the release of the data. Ether was 4.5% to $ 3,375 from 1:12 pm in New York, while the Bloomberg Galaxy Crypto Index increased 3.5%.

“What we see today is not ‘yay, inflation hedge’ and all that, and the dangerous stock is back,” said Noelle Acheson, chief marketing officer at Genesis Global Trading Inc. This is “because we do not expect Powell to raise prices as the market has been declining because rising prices were in line with expectations and not worse.”

To be honest, whether Bitcoin or any other cryptocurrency could be a good hedge of inflation is still a matter of debate, even well-known experts and investors. Some argue that Bitcoin has not been around for a long time to tarnish its inflation-hedge history, while Cam Harvey, a professor at Duke University and a colleague at Research Affiliates, has previously said it looks like a fantasy asset. they are prone to periodic damage.

“Judges are still appearing on Bitcoin to be an inflation barrier and only time will tell,” Austin Vincent, vice president of Gullane Capital, said in a phone call from Memphis.

However, Wednesday’s advance was welcome for anyone who has seen prices fall in the past few weeks as the Federal Reserve changes dramatically hawkish. New marketers have not been flocking since early December Bitcoin crash, according to a Blockforce Capital analysis that used Glassnode data. To make matters worse, many of the participants in the long-term market – who have come to the market in recent months – are underwater. As of Tuesday, the median price they paid was higher than the value of one Bitcoin, Brett Munster of Blockforce wrote in a letter.

There is a huge resistance around $ 52,000, “and until we break the top and hold, we can continue to see temporary instability,” Munster said. “However, if we go up and stay on top of it, sales go out and it becomes easier for the participants to re-enter the market. This could lead to the rise in prices that we have all been expecting.”