Billions at war: fighting for power over the Italian economy

In 2018, an Italian billionaire Leonardo Del Vecchio he returned to his hometown and volunteered to spend 500m at the country’s largest cancer hospital.

Milan Istituto Europeo di Oncologia’s refusal to accept the money sparked a war that is now raging in Italy’s two most important financial institutions: Mediobanca, a major corporate power; and Generali, Italy’s largest insurance company.

Del Vecchio, founder and chairman of the world’s largest eyewear business in Luxottica, declined to comment and criticized the hospital’s chief financial officer, Mediobanca’s financial bank. This has led to tensions between Del Vecchio and the bank’s chief executive, Alberto Nagel, according to a number of people familiar with the relationship.

“The animosity between Del Vecchio and Nagel goes back to where the money was taken.

Del Vecchio, an investor in Generali and Mediobanca, is he protested Mediobanca’s reliance on its 13 per cent stake in Generals for profit. At the same time, he and other shareholders of Generali are battling Mediobanca over the future of the group and its superiors under General Philippe Donnet.

The main contributor to the Del Vecchio campaign against General Managers is Francesco Gaetano Caltagirone, a 78-year-old tycoon who is the deputy chairman of the General and an Investor in Mediobanca.

In September, Caltagirone and Del Vecchio, the second and third largest insurers behind Mediobanca, signed an agreement with a retailer to discuss options before General’s annual general meeting next April. The group owns 14 percent of its shares.

The day of the General Road next month, when investors will hear his three-year plans, will be a “watery season” in the war of attrition, says Andrew Ritchie, senior analyst at the Autonomous research team.

He also expects “more of it” from Generali, focusing on economic growth and business recovery, adding: “This will require a response from those who complain about what they can do better.”

The regulatory dispute involving Italy’s two leading financial institutions and billions of older people is highlighting private and regional disputes over control of the country’s economy. “This is not a war of attrition, it is a war for freedom,” said a spokesman for Caltagirone, who increased his share in Generals from 1 to 8 percent over the past 12 years.

Del Vecchio’s role as a strong player in the industry came too late for his career. As soon as his donations to the Milan Cancer Hospital were rejected, he shocked Italy’s economy by announcing a 7 percent increase in Mediobanca. He now owns only 20 percent, which is allowed under the agreement reached with the European Central Bank.

He has used his position as Mediobanca’s chief Investor to promote a change in the management of the management of the management of the management of the media. management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system management system the management of the administration of the patent office or the patent or or & or its membership shall be limited. .

Up to one-third of Mediobanca’s revenue comes from Generali Holding.

“For the first time, Nagel was forced to take action,” said Del Vecchio’s close friend. “People think this is the last show – there’s a space in the sky that something has to change.”

Under a memorandum of understanding between Del Vecchio and Caltagirone, the two agreed to discuss how to get the “most effective and efficient” insurance policy.

The foundations of Fondazione CRT banks have re-signed the agreement, and Del Vecchio and Caltagirone expect the powerful Benetton family, which owns 4 percent of the General shares, to join.

The alliance has put Del Vecchio and Caltagirone on a collision course with Nagel and Mediobanca, who support General Managers. Mediobanca has responded by borrowing 4 percent of Generali shares, increasing its share by more than 17 percent. Mediobanca voting rights in the leased constituencies will expire after the General AGM.

In an effort to disrupt the process, Italian lawmakers recently decided to amend a law that would set a six-year limit for the term of office of executives and their members. This could affect Donnet and Gabriele Galateri di Genola, chairman of the General since 2011, and could be important to Nagel in the future.

Generali’s professional approach and his M&A approach are the two main points of disagreement between the insurance management team and the co-operatives. A person close to Delfin, Del Vecchio’s operating company, called Generali a “fintech laggard” and said his latest production was “a small mixed bag for planting flags and doubling in Italy, where he already rules”.

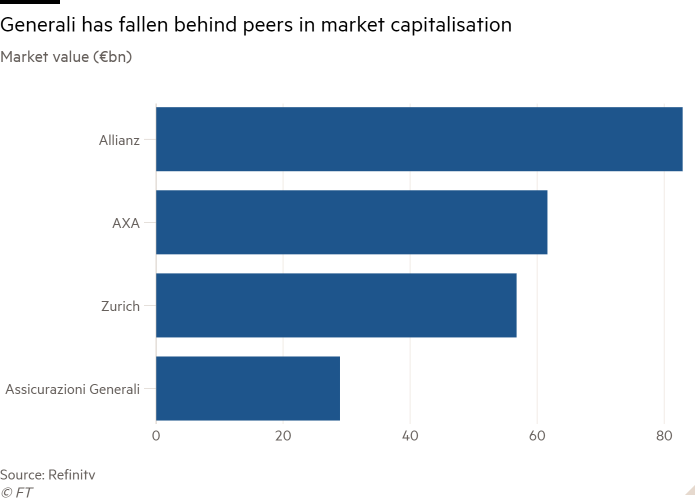

Opponents view Generali recently found Cattolica who has a problem as an alliance that is better for the Italian economy than those with Generali shares. People close to Caltagirone reported that the Cattolica agreement was “too late”. The general has fallen behind its financial backers over the past two decades.

“Generals need to find a way to grow naturally or [through M&A] which makes it very similar to those of Zurich, Axa and Allianz, who have led the way in Generals if you look back in the early 2000s, “said a senior stakeholder.

But sponsors point out that Generally shares have often performed better than their competitors since the last Donnet Plan was launched three years ago. Generally sales have risen 24 percent since then, compared with 5 percent in Allianz, 15 percent in Axa and 25 percent in Zurich.

Another criticism that has been leveled at Generali is that Mediobanca, his main shareholder, has too much power over insurance. The former Chairman of the General, Di Genola, was the chairman of Mediobanca until 2007.

The general declined to comment. But a psychiatrist said the Mediobanca story at Generali was “old-fashioned”.

“If you look at the business decisions made by Generals – M&A, strategic, you name them – it is impossible to see when something has been done for the benefit of those who have a share on behalf of all the shareholders,” the man said.

Del Vecchio and Mediobanca also declined to comment.

The question is whether any new strategy could defeat those who own the rebellious shares of Generali – or prevent investors from joining them.

A source close to Generali’s supervisors criticized Del Vecchio for “strategic infantilism”, adding: “He wants Generali to be the largest insurance company in Europe, if not in the world, but how to use it is unknown.”

The former leader of the Italian financial group said he did not expect the two sides to reach a climax before the AGM. “Billions will not give up,” he said.

“A lot of money is at stake, and when they reach the end of their lives, their reputation, their legacy and their pride are in jeopardy. It is very difficult to find an opportunity to associate with them. ”

Additional reports by Stephen Morris in London

Source link