Rising inflation brings real interest to those in the forefront

Rising inflation leaves the world’s leading economy and interest rates low for decades, with central banks delaying the stabilization of monetary policy to address the coronavirus crisis, saying recent inflation is long overdue. .

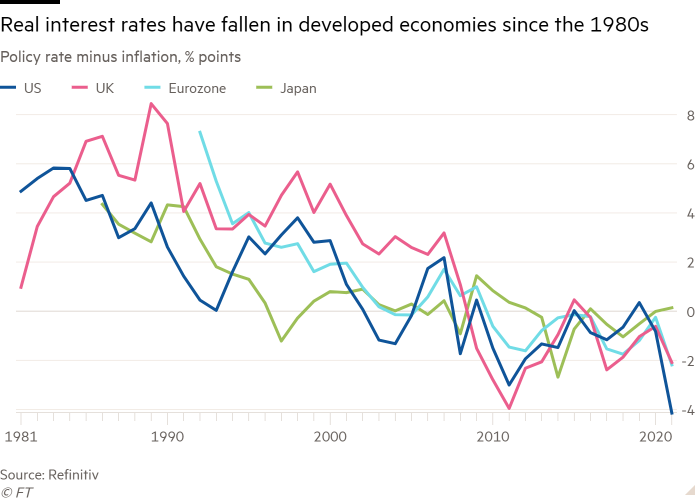

The real interest rate, which eliminates lower interest rates from the central bank, reflects the actual cost of borrowing and actual repayment on deposits. The combination of rising inflation in the US, the eurozone and the UK, as well as the idea of their central banks to remain patient when it comes to inflation, brings financial excitement even as these countries are about to repay what was lost.

Real interest rates “will remain very low for the next few years,” said Elena Duggar, executive director of Moody’s accounting firm.

In the US, where interest rates are close to zero, real prices stand at about -5.3 percent. They are at -3 percent in the UK and -4.6 percent in Germany, according to a Financial Times analysis.

These remain very encouraging handouts, which is why several studies showing real interest rates – which do not discourage or encourage lenders and investors – have fallen in the developed economy to almost zero today, from about 4 percent in the 1980s.

The last period of real prices was as bad as it is today in the 1970s, when rising commodity prices pushed up rising inflation, studies show. Real interest rates too fall following the 2008 financial crisis.

Wrong standards “make money more efficient and should support credit growth, because it makes the price of debt more stable,” said Ana Boata, chief financial officer at Euler Hermes Group.

This could help governments pay off the huge debts they incurred during the epidemic. However, since inflationary pressures lead to financial instability, Boata warned that it could lead high-value financial markets to become “volatile,” leading to concerns about economic stability “.

The biggest exception is China, where real prices are already good even though they are declining. Last week, the Czech Republic and Poland joined forces with Russia, Mexico and Brazil in raising interest rates. But rising inflation means that real prices remain poor. However, with inflation expected to fall next year, real prices will remain positive – rising to 3.3 percent in Brazil and 3 percent in Russia – reflecting a risk known as an investment risk in the coming markets.

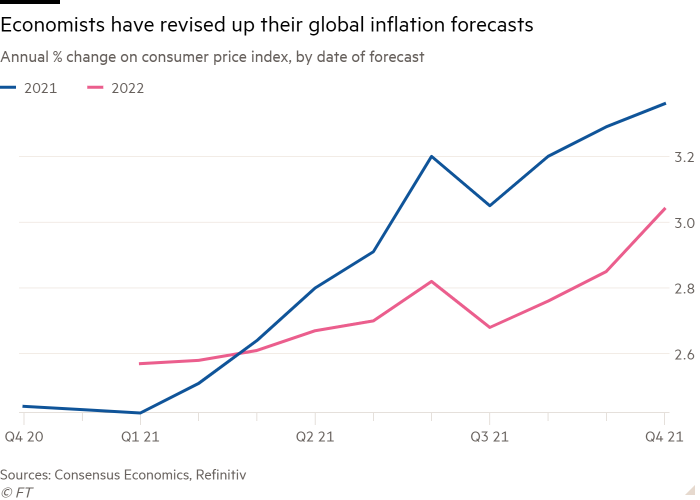

In developed countries, central banks are slowly removing the huge inconvenience caused during the epidemic, although economists have made some predictable increases in inflation as a result of retail difficulties and rising electricity prices.

Last week, U.S. Federal Reserve chairman Jay Powell said it was too early to raise interest rates. The Fed, which has begun lowering its bond-buying policy, said the US inflation rate – which is up 13 years and 5.4 percent – was due to a number of factors. “Expected to pass”.

Christine Lagarde, President of the European Central Bank, also pushed back on expectations that prices will rise next year despite inflation rising to 13 years of 4.1 percent in October. He also said the ECB, which has also reduced its bond program, expects inflation to fall next year.

Similarly, the Bank of England last week back from the rapid increase in nominal prices from their record low of 0.1 percent, although it predicted that inflation would reach 5 percent by early next year before returning.

However despite rising prices, real prices are expected to remain poor. According to the 2022 inflation forecast, real prices are expected to stand around -3.3 percent in the US, -2.7 percent in Germany and -3.2 percent in the UK.

Even central banks a Canada and Australia, which has shown that they can raise prices in the near future, lowering the price target by more than 3 percent plus almost zero interest rate also means they have real wrong prices.

“The actual standards will be much lower compared to what has already happened [rates] future, “says Neil Shearing, an economist at Capital Economics.

Source link