Rising NFT investors face billions in taxes | Crypto News

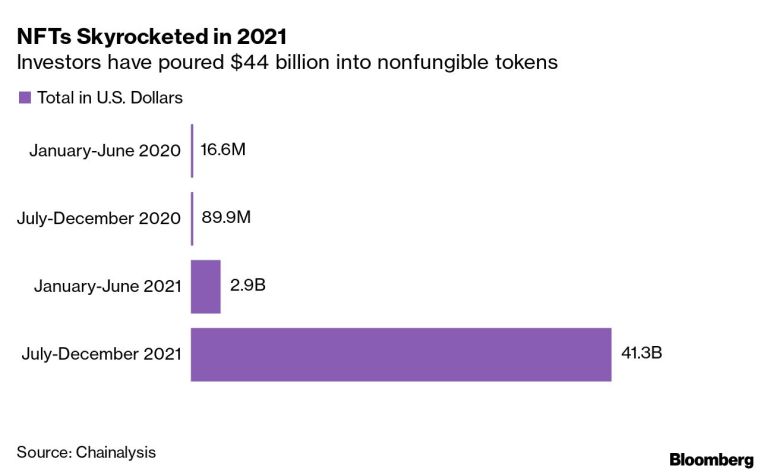

The NFT market has risen to $ 44bn, Chainalysis data shows, and the rules regarding token tax are not clear.

It is one of the hottest corners of crypto – and now the US government wants its share of profits.

Investors and manufacturers of nonfungible signals – a market that has ballooned for $ 44 billion, Chainalysis data show, and attracted Justin Bieber fans to Melania Trump – meet billions of dollars in taxes and prices up to 37%, according to tax experts. Officials from the Internal Revenue Service who are cracking down on tax evaders say they are planning to crack down on them.

The surprises are coming for NFT enthusiasts as the tax season begins this month with the recent resurgence of crypto from Washington as US government officials focus their attention on a growing number of companies. The rules regarding tax tokens are unclear, leaving NFT taxpayers just looking to calculate the amount of debt they have. Advertisers may not realize that they have to pay any taxes or that they have to pay more than once a year, adding to the potential for future benefits.

“You should not mention the pros and cons because the IRS has failed to provide you with guidelines that meet your expectations,” said San Francisco taxpayer James Creech. “It’s very difficult for people to get the right attitude – or right, it ‘s easy to ignore.”

The NFTs have found interest as demonstrations of digital technology and are expected to be an important part of the so-called metaverse that experts like Mark Zuckerberg call the future of the internet. Signs and certificates are real and non-repetitive digital certificates, which can increase its value.

Token sales grew significantly last year, with NFTs such as CryptoPunk # 3100 – with a guest player – selling $ 7.7 million after the first $ 2,000 price tag in mid-2017. “All Days: First 5,000 Days” from digital artist Mike Winkelmann, also known as Beeple, sold for $ 69.3 million.

As is often the case in the crypto world, it is difficult to compare tokens with more traditional currencies and regulators including those in the IRS struggling with how to use them.

When a manufacturer sells NFT on a platform like OpenSea or Rarible, most taxpayers agree that profits should be considered a standard investment and should be as high as 37%. Advertisers who purchase the tokens are subject to income tax if they use another cryptocurrency when purchasing, and when they sell.

In addition, the process is risky. There are questions about whether tokens should be taxed as “collecting” art, which comes with a long-term profit of up to 28%. This compares with 20% of most cryptocurrencies and shares. President Joe Biden’s development law, which he signed into law last year, makes it difficult for people to hide digital assets, but the Treasury Department has not said whether this includes NFTs.

It is difficult to calculate exactly how much tax there is, but experts like Arthur Teller, chief of staff at TokenTax, estimate that the total NFT tax revenue could reach billions. “Some people are unaware that they have a quarterly tax debt and could face penalties for defaulting annually,” said co-founder TokenTax, Zac McClure. Some people may not be aware of the need for disclosure, says Shehan Chandrasekera, head of tax services at CoinTracker.

Tax evasion

With so much money at stake, the IRS will be forced to explain the rules, but it could start to read the public first, says Michael Desmond, a former IRS MP who is now a Gibson colleague, Dunn & Crutcher.

IRS investigators are planning to undergo surgery that could be performed this year.

“Then we will see an increase in the NFT type of tax evasion, or other crypto-property tax evasion is coming,” said Jarod Koopman, senior director of cyber and forensic services at the IRS investigative unit.

In the meantime, NFT afisionados should insist on more records.

“It’s very difficult,” said Adam Hollander, an NFT investor and producer of the “Hungry Wolves” team, adding that he has spent 50 hours plus several months. “There are people who would not want to do what I do.”

-With the support of Beth Williams.