Investments in stocks break the record

Advertisers are pouring money into companies around the world with a joy that has never been seen before.

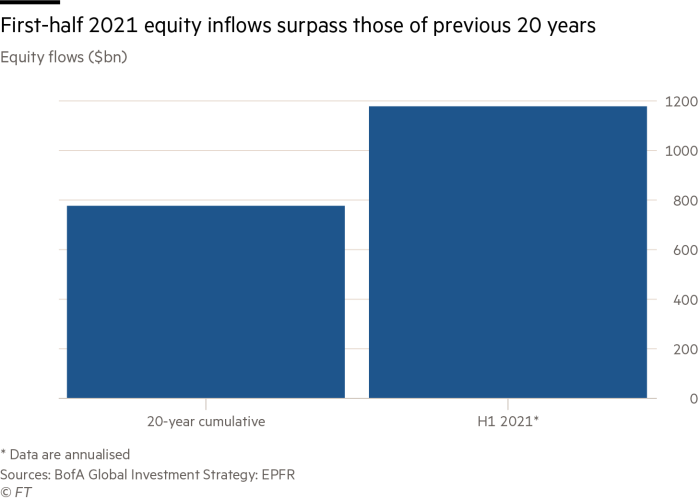

Approximately $ 580bn has been added to the band in the first phase of 2021, putting the band on track, according to EPFR data providers.

The Strategists of the Bank of America estimate that if the transaction continues at the same clip for the rest of the year, the investment will contribute more money in 2021 than in the previous 20 years combined.

Investment management has set up an increase in the stock market, with major indicators rising to a record high last week as the economy recovers. The S&P 500 has risen more than 15% this year, while the global FTSE index has gained more than 12%.

Low yields – as well as more than $ 12tn in debt sales and less than zero yields – have increased market interest in $ 117tn.

“There has been a real change in the economy and where economic growth is coming from,” said Diane Jaffee, event manager and treasurer at TCW. “Even with the most accurate estimate of inflation, your actual return on bond is not worth it.”

The results have been significant, with the addition of total global currency as well as currency that buys US, Japanese or European stocks. Investors in recent weeks have also shown interest in the economy and technology in the US, as they debate how to keep the recession afloat and whether the trade is called reflation keep shaking.

Additional representation fees, by contrast, have been adjusted this year to $ 33bn, which the EPFR has shown.

Jaffee said he hoped the economy would continue to love stocks this year, especially in the US where the country has released the Covid-19 vaccine more quickly than in the more developed markets. But he and others have warned that the crisis in yields – for example from the misconceptions that the US central bank has set – is a serious risk.

“Even though we’re at a much higher risk right now, the issue of miscommunication is available,” said Nicholas Colas, founder of DataTrek.

Colas noted that US stocks were performing well even after the 2013 crisis, when a Federal Reserve official called for a slowdown in the market, saying the central bank would sometimes reduce its bond-buying activity.

But Colas added: “While the 2013 crisis season was good for stocks, we can’t say for sure that this time would be different.”

Source link