The poorest countries are facing an $ 11bn increase in debt repayment

The world’s poorest countries are facing an increase of $ 10.9bn in debt repayment this year after many rejected it. international support and instead turned to major markets to provide funding to address the epidemic.

A group of 74 low-income countries have repaid $ 35bn to lenders in two regions and government agencies by 2022, according to the World Bank, up 45 percent from 2020, the most recent findings.

One of the countries most at risk is Sri Lanka, where S&P Global’s finance agency last week warned of a possible instability this year as it lowers its national bonds. Advertisers are also affected by Ghana, El Salvador and Tunisia, among others.

David Malpass, president of the World Bank, warned that “digging for. . . with debtors ”means“ the risk of debt default increases ”.

“Countries are facing a recurrence of debt when they have no capital,” he said.

The increase reflects developing countries taking on more debt to address the economic and health problems associated with coronavirus, as well as rising debt repayment and the resumption of debt that was suspended after the outbreak.

About 60 percent of low-income countries have to repay their loans or are at risk of doing so, and a debt crisis could occur, the World Bank has warned of financial instability. published last week.

Governments and corporations in low- and middle-income countries provide $ 300bn annually in 2020 and 2021, more than a third of the population before the epidemic, according to a study from the Institute of International Finance, a financial institution.

The approaching repayment rate comes in the wake of a global epidemic of debt relief, which showed a wet squib.

The Debt Service Suspension Initiative, launched by the G20 fiscal group in April 2020, aims to delay the $ 20bn loan that 73 countries are required to borrow between May and December 2020. accessory by the end of 2021, only 42 countries he found relief $ 12.7bn, according to the Paris Club group of debtors who helped coordinate the project with the World Bank and the IMF.

The countries are expected to start repaying this year and start repaying the loans suspended by the policy.

Currently, rental rates are rising.

In the first two years of the epidemic, lower interest rates by central banks forced lower interest rates. But since investors expect the global currency to stabilize by the end of this year, it will be more expensive to repay existing loans.

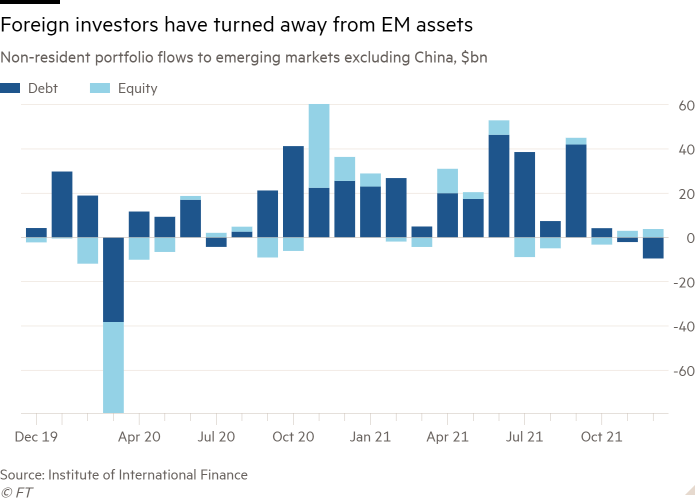

Developing countries under the auspices of Brazil and Russia have been raising prices for months to curb rising inflation. But in many countries interest rates are still very low in inflation, and cross-border payments are flowing from emerging markets with bonds.

“Finding a market is a great thing to have cheap money out there, but there may be different perspectives as things get worse,” said Ayhan Kose, chief of the World Bank’s forecasting unit.

Treasurers, economists, and debt lenders have all called for action to reduce debt in developing countries.

“Debt problems are on the rise and funding for developing countries continues to decline. We are truly at risk of another decade of loss for poor countries, ”said Rebeca Grynspan, secretary-general of the United Nations Conference on Trade and Development.

Gregory Smith, a marketing expert at M&G Investments, says: “Another debt crisis, even if it does start, can have a profound effect on debt-ridden countries. . . We have a year or two of developing projects to help countries facing economic crisis. ”

Debt-ridden countries could seek relief from the G20 plan to replace DSSI. “Agreements” require the participating countries to first negotiate with the IMF lender, and then to secure the same loans to ordinary creditors.

However, critics say this could prevent countries from gaining greater markets. Only Chad, Ethiopia and Zambia have applied and the negotiations are showing signs of success.

“You know what it means for a country to openly say it has a problem with debt repayment,” Grynspan said. “Businesses are not afraid. If the world has a choice, it cannot do that.

Source link