Wall St at the top while Nasdaq finished filming for the third time in a row

Shares on Wall Street rose sharply Thursday after a hawkish downturn by the US central bank has diminished interest in groups whose assets are linked to economic growth.

The heavyweight Nasdaq Composite rose by half to 0% in the afternoon in New York, leaving it on a well-known line for the third consecutive quarter. The technical components were identified, with Tesla the electric car manufacturer and the Peloton fitness team. The S&P 500 largest blue was also the highest, up 0.6%.

Federal Reserve officials brought their first-ever demonstrations after the epidemic one year ago, which devastated the market last week. The sale has stabilized after Fed chairman Jay Powell also alarmed that major obstacles remained in the setting of monetary policy.

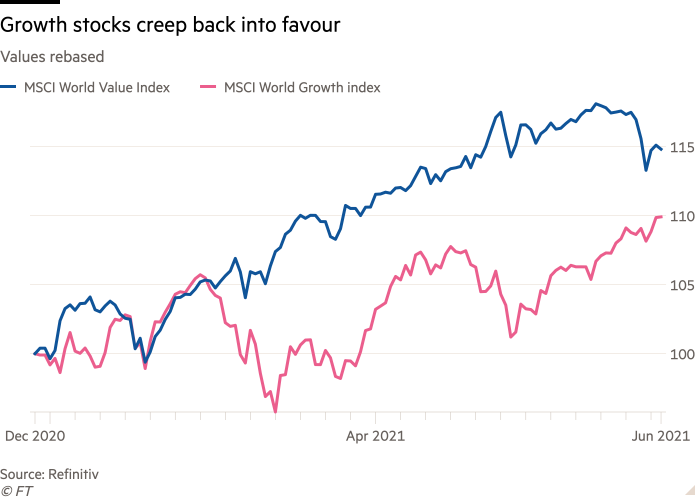

Advertisers too changed their portfolios not to rely too heavily on financial resources in companies such as power and banks that have controlled market growth since pharmacists announced the effective Covid-19 vaccine last November.

“The market has bought into a recession that will be shorter than previously expected,” said Bastien Drut, an expert in CPR Asset Management, referring to the period between the sudden recovery of the epidemic and the subsequent economic downturn.

The technical and other so-called growth companies, whose accounting is affected by estimates of future profits, have also been shown due to the decline in long-term government yields that impose fines on companies’ corporate fees.

The Fed’s actions last week disrupted five-year inflation rates and raised 30-year bonds. Yields on 30-year-old Treasury stocks, which have moved irreversibly, fell from more than 2.2% last Wednesday to 2.09%.

“The pace of this massive move has been tremendous,” said Roger Lee, an expert at Investec.

Elsewhere, sterling has come down from a strong margin against the euro since early April after the Bank of England said its timing epidemic “remained relevant”.

The BoE said the UK “will have a period of temporary growth” and high inflation “after which growth and inflation will return”.

The pound, which traded at € 1.17 ahead of the BoE currency exchange meeting on Thursday, lost 0.4% compared to the single currency to € 1.1664. Against the dollar, sterling also fell 0.3% to $ 1.3912.

London’s FTSE 100 list, which is filled by exports who benefit from weaker pounds, closed 0.5 percent.

Yields on the UK’s 10-year government contract, which moves in its price, fell by 0.04% to 0.74%.

In Europe, the share of Stoxx Europe 600 shares rose 0.9% after Ifo Institute business rose sharply than expected to rise to 101.8 in June, from 99.2 last month, showing optimism among corporate executives in Germany, the economic power of the euro . Frankfurt’s Xetra Dax also finished the session with 0.9%.

Raw Brent, the world oil, rose by 0.3% to $ 75.42 a barrel.

Unsafe – Market, economic and strong ideas

Robert Armstrong disrupts the most important events in the market and discusses how well Wall Street positive ideas respond to them. Enter Pano for this letter to be sent to email every week

Source link