Form Summit: ‘fear of scarcity’ helps rising oil markets

“Negative fear” has taken hold global markets, upgrading everything from stocks to cryptocurrencies to record ups and forcing even tough bears to throw in the towel.

U.S. equities are at risk of global stocks that have nearly doubled the number of MSCI All-World segments since the coronavirus nadir outbreak in March 2020 – one of the most powerful in the world.

The Wall Street’s S&P 500 this week published the longest record since 1964 shortly before its return, according to the Bank of America. In the meantime, digital imaginary currencies such as bitcoin, ethereum and “meme currencies” like Shiba You have risen sharply, leading to the crypto market price. about $ 3tn from under $ 500bn during this period last year.

“The market has become a video game,” said Peter van Dooijeweert, general manager of Man Group, the world’s largest cited by the hedge fund manager. “Sounds like Candy Crush. ”

Researchers and investors say the reason for the conference was the proliferation of interventions that central banks around the world have done to stabilize the global economy during the epidemic last year and to ensure economic recovery.

This has left many economies at low risk such as high government bonds that offer low incomes and, in many cases, yields that are worse off when global inflation is considered.

Researchers and investors say that the stock market has risen sharply by a rising in retail sales which began when many people faced developmental constraints last year, but continued when the economy reopened. And the symptoms of euphoria are on the rise.

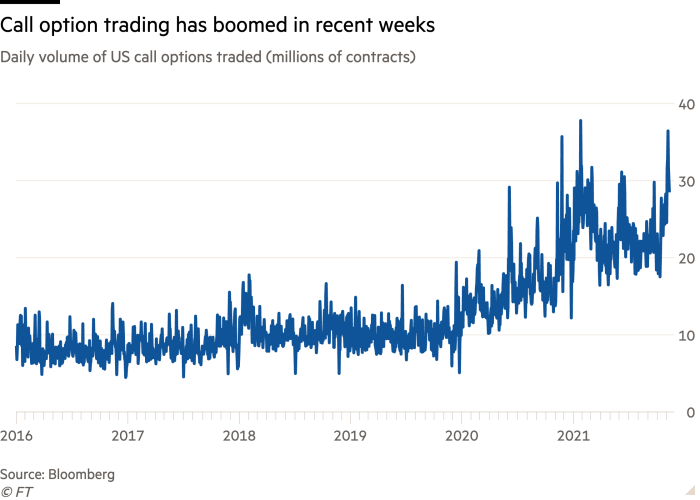

On November 5, the $ 2.6tn price target – a spring break that allows investors to bet heavily on or against stocks and leases – changed hands in the US, the highest rate on most trades, according to Goldman Sachs. Trading volumes are now about 50 percent more dollar-denominated than any real trade, the investment bank estimates.

Many of the options that are on sale are so-called “phones”, a springboard that allows investors to make aggressive bets so that commodity prices will rise. The US mobile phone sales are now back in the decade that appeared in early 2021, according to Nomura. This has led to the number of mobile phones being kept, which provides insurance against the market downturn, down sharply since June 2000, just before the dotcom explosion.

“There are more choices than real money. It has a huge impact on the market,” said a senior executive of one large trading firm. I don’t think this will last forever.

Merchants has been very impressive in terms of trading volume, and the Nomura-Wolfe basket of prominent US stocks and current traders has gained about 150 percent this year, compared to the S&P 500 gain of 24%. “There are obvious signs of sharpness,” Raghuram Rajan, a former governor of the Reserve Bank of India, said at a press conference earlier this week.

Some experts are also starting to panic. Charlie McElligott, a freelance expert in Nomura, said he heard “yikes” watching the markets right now. “It looks like ‘Peak Form’ is getting into the realm of fantasy,” he wrote to clients this week.

Demonstrating how difficult the site is for declining investors, Russell Clark’s Russell Clark Investment Management finally threw in the towel this week, closing his London-based hedge fund after trying to lean on the market for the past decade.

Globally, $ 865bn of new investments have been thrown into trade finance this year, according to EPFR. This is already almost three times more than the previous full year’s history, as well as the 20-year-old combined fundraiser.

Some experts say the meeting could be even worse next month. McElligott also noted that U.S. corporate purchases were about to start again after a shutdown when quarterly earnings were reported, and that the fund became stronger by the end of the year.

Combination. These factors could push markets further into 2022, he said. “It’s a game book that could end at the end of the year that I think people are ‘forced to play’,” he wrote.

Barclays analyst Emmanuel Cau agrees that the market could rise sharply than in the recent past. “The market is getting hotter, but the startups are contributing to the economic growth,” he wrote. “The form is great, but all the placement has not been stretched.”

However, the controversy is confusing many investors, who suspect that what was powerful but clear from the coronavirus outbreak could be very dangerous.

“Everything looks crazy, there is foam here, foam there, everywhere,” said Erik Knutzen, chief economist at Neuberger Berman. “It’s been a while, but we’re in an uncharted waters, a very strange place.”

Weekly letter

For the latest news and fintech views from the worldwide FT press network, subscribe to our weekly newsletter. #fintechFT

Source link