Gambling banks in Russia face new tests of their passion

Western banks have become accustomed to the political turmoil in Russia. Société Générale, which was first established in the country 150 years ago, was forced to stand for 56 years after the Bolshevik Revolution in 1917.

Since its return, the French lender has gone through the end of communism, the instability of Russia in 1998 and the occupation of the Crimean peninsula in 2014.

Now, with Russia’s military presence on the Ukrainian border, SocGen was one of the banks announced earlier this month by the European Central Bank. The Financial Times revealed this week that the ECB had warned lenders with a Russian presence to prepare for the imposition of international sanctions against the country if Ukraine is to be seized.

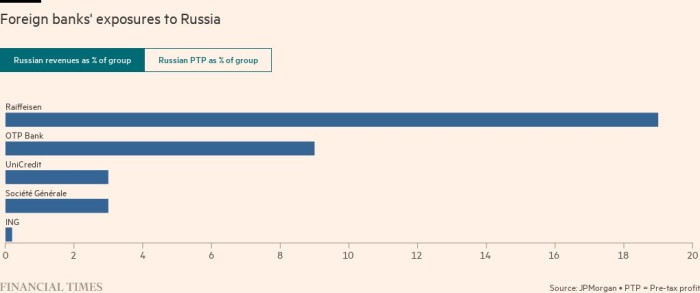

Along with SocGen, Raiffeisen Bank of Austria and UniCredit of Italy are some of the most active European banks. The three together account for 3.7 percent of the assets in the Russian banking system, according to data compiled by JPMorgan.

Their presence differs from major Wall Street banks, including JPMorgan and Bank of America, which greatly reduced their appearance in Russia after the Crimean invasion.

As a result, the Kremlin pursued a “Fortress Russia” method to not rely on foreign currency. Corporate lending from foreign lenders dropped from $ 150bn in March 2014 to $ 80bn last year, according to Russia’s largest bank.

However, cross-border relationships remain important. Information from the Bank for International Settlements indicates that international banks, including their Russian counterparts, he owes $ 121bn and Russian agencies. Lenders in Italy, France and Austria have many claims in a row.

For the remaining lenders, including the Hungarian OTP Bank, the Russian market still has its attractions. Commercial banking finance is attractive, while profitable trade, finance and technology can be made, especially from the energy and environmental sector of the country.

Indeed, UniCredit CEO Andrea Orcel said Friday that the Italian lender he was trying to find of Russian government lender Otkritie before the political crisis in Ukraine escalated.

UniCredit, Italy’s second-largest bank, entered the Russian market in 2005 through a joint venture with Bank Austria, a former subsidiary of Moscow.

Among other things, the ECB requested that banks monitor Russia’s outlook and emergency plans for sanctions.

Several European banks operating in Russia said they had been making preparations before being warned by the ECB.

“We do not need authorities to ask us how we are doing in order to avoid accidents in order to take action,” the head of a European bank told FT.

“When you follow the story, you will obviously be looking at what you have shown. Whenever there are international conflicts and economic uncertainty, you always look at your history.”

An official at a European bank with a major Russian company said it had increased its preparations over the past three weeks, increasing its investment rate in anticipation of troubled customers taking cash. It also tripled the amount of money available for its appearance in Russia, he said.

Following the brutal strike in 2014 when Russia met with sanctions in the Crimea, the bank imposed restrictions on all its lending agreements so that customers affected by the sanctions could not repay their debts and have to repay existing debts. said the official. The bank has also devised ways to reduce the risk of further penalties and financial losses.

Some banks affiliated with FT said they were “waiting and seeing” while efforts to resolve the dispute continued.

One US-based US-based bank with Citigroup, with $ 5.5bn in debt, securities and other assets tied to Russia at the end of the third quarter of 2021, according to a recent 10-Q bank reservation at the Securities and Exchange Commission . This accounted for 0.3 percent of its total assets.

Last April, Jane Fraser, head of Citigroup, said the bank was selling its products in Russia, along with those from 12 other countries. Citi declined to comment.

Although SocGen claimed to have made its first investment with a Russian company in 1872, the bank’s exposure to 2.6bn in the country mainly through its company Rosbank. It bought 20 percent of Rosbank in 2006, and led many to two years later during the financial crisis.

The business generates 3 percent of SocGen’s net revenue and 4 percent of its pre-tax profits, according to JPMorgan estimates.

“Given the emergence of SocGen in Russia, this could lead to more political instability in the region,” said Azzurra Guelfi, a researcher in Citi.

SocGen reduced the apparent risk in Russia, saying “Rosbank is doing business on a regular basis within the existing system,” that “it has local affairs” and that the bank “was confident that we could ensure that this transaction took place. For our customers”.

In addition to the banking services provided by SocGen, Rosbank operates home insurance, car rental, rental, manufacturing and receiving services.

Although Raiffeisen has a direct presence in Russia like SocGen, the country’s importance to the overall value of the Austrian bank is very high. Its Russian operations took 19 percent of the revenue and 35 percent of the group’s profits before paying tax last year.

Under the worst sanctions imposed by experts at JPMorgan, Mr. Raiffeisen was severely affected by a 99-percent drop in its share of the capital, a measure of his financial strength. SocGen will be the second largest bank affected by 33bp, according to estimates.

Lenders in Vienna have long been leading banks in Central and Eastern Europe, acting as a gateway between Russia and the West.

But Raiffeisen alone directly entered the Russian market in 2006 and took over Impexbank. The alliance was part of Raiffeisen’s massive growth in central and eastern Europe over the past three decades.

Over the past year, it has focused its efforts on its Russia and Ukraine branches in major cities, closing down branches in remote and less productive areas.

Raiffeisen declined to comment.

Additional reports by Gary Silverman in New York

Source link